An economic slowdown is inevitable – and that is probably a good thing. Why? While most people would probably choose to have permanent, strong economic growth if it were possible, there is a reality to underscore. Economic growth is not felt similarly across all parts of society. The disparities between those participating in the growth and those who are not can also become larger over time.

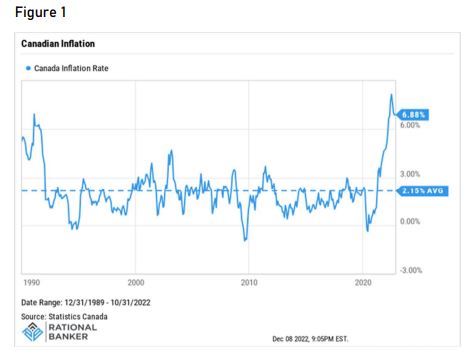

Interest rates are the key tool in monetary policy used to influence the rate of inflation and ultimately economic momentum. With inflation running well above levels we have seen in decades (see Figure 1), policy makers have been raising interest rates to help cool inflation. Reducing inflation from unsustainably high levels provides broad economic benefits, directly and indirectly across the economy. A few ways that higher interest rates make an impact are listed below.

Savers – Positive

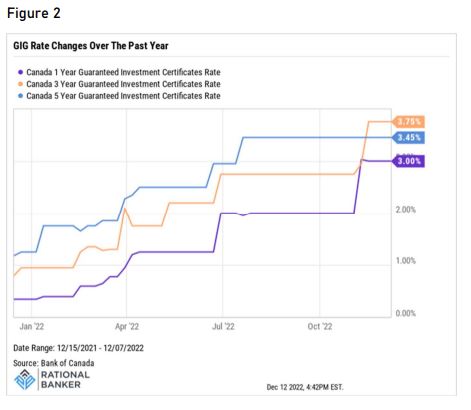

For those of us fortunate to have stashed away money in savings accounts, money market funds, GICs, etc. for different reasons, higher rates are welcome news. earning paltry returns for years, higher rates are welcome. For many, these savings were designated for specific purposes and could not be exposed to high risk, so there were few alternatives. With rising interest rates, this group has finally benefitted from an improvement in lower risk investment options providing interest at levels that look terrific compared to just a year ago (see Figure 2).

Real Estate – Positive or Negative, Depending on the Situation

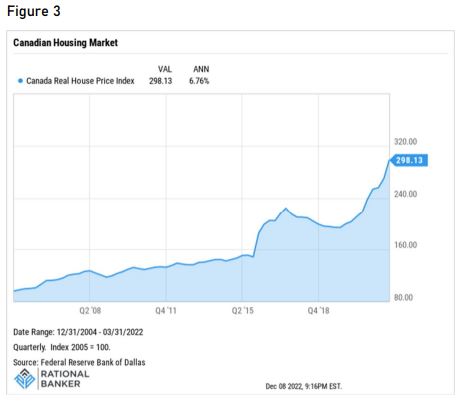

Home ownership is an aspiration for many. It is also the most expensive purchase most people will make in their lives. Home prices have increased significantly over the past few years and particularly during the rising trend of remote work during the pandemic. Generally, people take on a mortgage to finance their purchase, and with prices having risen faster than household incomes, it required ever larger amounts of debt to be taken on for a purchase. This either priced people out of the market, or drove them to take on ever larger debt loads – the latter is unhealthy and unsustainable.

So, while higher interest rates are making it more costly to pay off your debt, it can help slow overall demand for credit and in turn, housing. This may help bring prices back to more reasonable levels by improving the supply and demand dynamics of residential real estate, particularly for first-time buyers. The latter point can also help to remind some homeowners that the who, after the degree of price appreciation in recent years, may have come to expect it as the norm rather than the exception. Many have tapped into that home equity as though it were an ATM to fuel further spending while racking up more debt in the process. That leaves them more vulnerable to higher rates or risks of job losses in the event of an economic downturn.

Figure 3 below shows Canadian house prices have tripled in value since 2005 after adjusting for inflation.

Re-pricing Risk Assets more Rationally – Positive

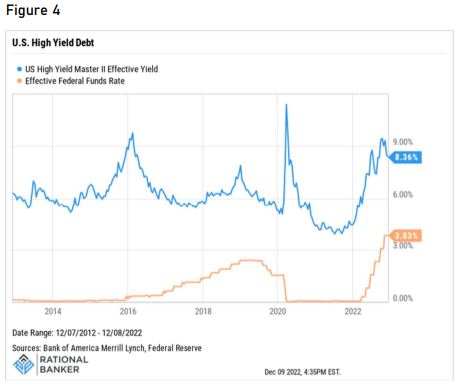

Low interest rates persisted amidst tame inflation and lower economic growth for much of the past decade. As opportunities to generate fixed income from quality bonds became increasingly limited, investors climbed higher up the risk ladder to generate yield income. This pushed prices of high-yield bonds higher and their yields lower. Increased risk appetite for other risk assets was also fueled by the demand for higher returns in a low-yield environment. Growth equities, particularly large-cap U.S. tech stocks, were a prime example. The re-pricing of risk assets to reflect more appropriate risk-reward trade-offs is a healthy development. Higher interest rates have been an important driver of this re-pricing to more sensible levels. The more complacency with risk, the higher the possibility that any market volatility down the line could be magnified buy investors panic selling previously misunderstood investments in search of safe-haven assets.

Figure 4 shows the yields on U.S. high-yield corporate debt reaching all-time low levels last year before moving significantly higher over the course of 2022 alongside the Fed’s interest rate hikes.

Reign in Household Borrowing – Overall Positive, but Some Drawbacks too

Low interest rates fueled a boom in credit demand every corner – governments, businesses, and households. The key benefit of the credit boom has been that spending has kept economies growing. However, the fact remains that at some point the debt accumulated does need to be paid back or at least paid down. Governments and businesses may be able to pull on different levers to get through challenging economic conditions and deal with their debt. Households can be more vulnerable to risks such as rising rates or job losses. While household net worth has improved meaningfully over the past few years thanks largely to rising house prices and stock markets, the values of those assets do not always go up. This year’s market volatility underscores that point. Debt, on the other hand represents a sticky obligation that has to be dealt with no matter your circumstances.

Rising interest rates may be a necessary wake-up call to those who have become too comfortable with high levels of low-cost debt. While this means that higher interest rates may cause a drop in overall spending and thus slowing growth, that is a better situation than endlessly debt-driven spending that further fuels inflation pressures, creating a vicious circle to make ends meet.

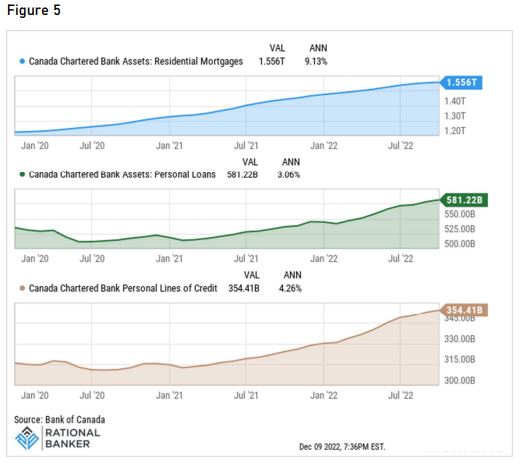

Figure 5 shows the annualized growth rate in different types of debt held by Canada’s chartered banks over the past three years. Prioritizing paying down debt can help avoid the risk of being burdened by higher debt servicing costs later.

Final Thoughts

For much of the past decade, inflation has not posed a major challenge. The COVID-19 pandemic put significant constraints on supply chains while also creating labour shortages across sectors. As economies reopened, pent-up demand exacerbated these issues and drove inflation rates across the world to levels not seen in decades. While working on solutions to reduce supply chain risks and worker shortages are being implemented, they do not have an immediate impact.

Higher interest rates are needed as part of the answer to help cool the level of consumption and demand from various end markets to avoid risking an even more significant economic shock occurring. The higher levels of interest rates are not permanent, and just as we moved from ultra-low interest rates previously, rates can come down again when higher levels are no longer warranted.

Disclaimer: The above information does not constitute advice, nor is it a recommendation to buy or sell any investments or financial products and services. While the information contained is believed to be accurate, neither Rational Banker nor any persons or entities associated with it can be held responsible for any errors. Prior to making any financial decisions, please do your own due diligence and/or speak with a professional to determine the suitability of such decisions.