Trees that are slow to grow bear the best fruit

– Moliere

Investing need not be an exercise in sophistication and complexity. It boils down to creating a few good habits and consistently executing on them. While this sounds conceptually simple to do, the reality is that we as emotional beings are often our own biggest hurdle in seeing these habits through. Often, the reason realistic long-term financial goals do not come to fruition is driven in part by our behaviours and biases. That is a separate discussion altogether, but for now, focusing on a few key ideas that are relevant and constructive for any investor that is interested in sustainably growing their wealth.

Develop A Plan, Keep It Updated, And Stick To It!

Whether you decide to work with a professional advisor or go it alone, financial well-being is an important contributor to peace of mind. Creating a thorough plan is necessary not only to get started with investing, but also to hold us accountable and remain objective about decisions being considered. This is especially the case during market downturns, where stress and emotion can often get the better of us. Having a detailed plan in place can help us reduce the possibility of taking action based on short-term developments that can be detrimental to our long-term financial health.

Save Early, Save Often

One of the biggest factors that influence wealth accumulation is time. Simply put, the sooner you start investing, the higher the likelihood to successfully attain your goals and vice versa. Crating a disciplined strategy as you begin your career also means it can be easier to maintain it as personal circumstances inevitably change. Imagine how much harder it can be to implement a savings and investing strategy when you’re already dealing with a mortgage or rent, car payments and other personal or family expenses where trade-offs need to be considered. Paying yourself first, by making automatic deductions from your pay if you are an employee is a great way to ensure this gets done without procrastination. If you need more convincing, take a look at Table 1 below to show the benefits of time when investing.

As seen above, by starting 10 years earlier, for every dollar invested over the full period, an investor would have a little over $2 in market growth for every $1 invested. Starting 10 years later, an investor would have a little over $1 in market growth for every $1 invested. Given the underlying investment remained identical, the impact of time clearly shows the benefits of investing as early as possible.

Quality Income-Generating Investments Have A Place In Most Portfolios

Full disclosure – I am a big fan of dividend investing so there is clearly some bias here. However, having a diverse range of income generating investments, including from dividends, fixed income investments, or alternatives such as real estate can be a solid contributor to long-term total returns and wealth creation.

There are few tangibles when it comes to investing, but income is one of them. You can spend it, invest it, or put it aside for future needs. Beyond that, during times of market volatility, while asset prices can fluctuate in value substantially, quality income-generating investments are likely to continue generating that income. This can help cushion the impact of declines, while providing an opportunity to use cash flow constructively. It can be used to reallocate or rebalance the asset mix within a portfolio while reducing the amount of buying and selling of underlying holdings. Further, it can be a timely benefit that can be reinvested at times when emotions can make it difficult for investors to commit new funds to their plan even if attractive opportunities arise.

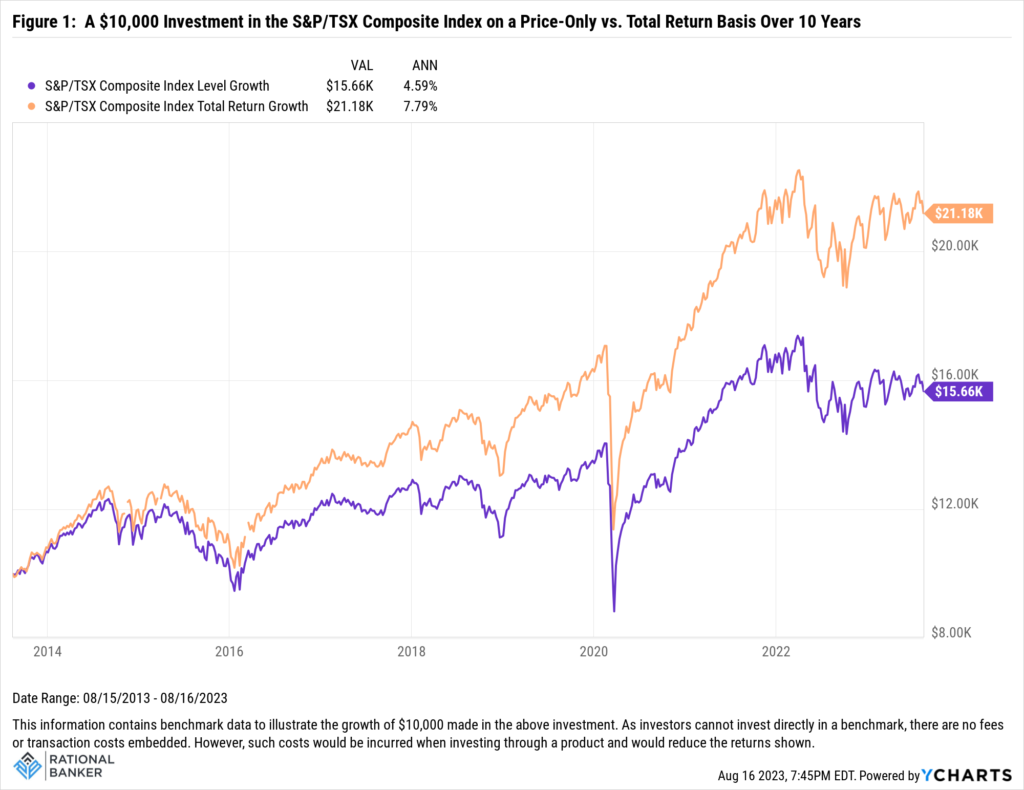

There can be a misperception that growth and income are trade-offs of one another. This is simply not the case as there are a wide range of equities and strategies that have exposure to both of these qualities. Additional income-generating assets can offer diversification benefits by reducing correlation between different asset classes within the portfolio. Figure 1 below shows the difference between the growth of a $10,000 investment based on price returns and total returns (including dividends) of the S&P/TSX Composite Index over a 10-year period.

Maintain Appropriate Diversification And Rebalance At least Semi-Annually

Investing is all relative. Different holdings will perform differently over a given period of time. It can be tempting to look at your portfolio and see one star performer leaving others in its dust and think about moving more money from underperforming investments into it. Concentration risk, resulting from having too much exposure to a given investment or asset class, can be a common pitfall. Determining the appropriate level of diversification, based on your risk tolerance, investment experience and long-term goals will help avoid this risk and reinforce the discipline of staying invested according to your overall plan. Remember, past performance is no guarantee of future returns. See Figure 2 for an illustration of the variability in performance of a variety of investments from year to year.

Rebalancing is a valuable, if not underrated step in the investment process. It helps reduce the potential for the asset mix within a portfolio from drifting materially from its intended long-term target or strategic mix. A sustained outperformance in a particular asset class can drive the value of this component to a larger size than intended and vice versa, throwing off the investment risk as well. Ensuring that rebalancing takes place either manually or automatically at least semi-annually can limit the impact of drift on your portfolio during volatile periods.

Final Thoughts

While there are a variety of different investing strategies available to investors in supporting their respective goals, one of the key influential factors is the importance of developing constructive habits and routines. Investing can be simplified or complicated depending on the degree of customization sought out within one’s investment portfolio. However, being consistent in sticking to a well-crafted plan, accepting that risk is unavoidable in investing, and maintaining a long-term perspective are more likely to improve the odds of achieving financial goals than trying to find the next star performing investment. This can be easier said than done, so determining whether it can be accomplished alone or if working with a professional is needed should be addressed early in the journey.

Disclaimer: Data sourced from YCharts unless otherwise noted. The above information does not constitute advice, nor is it a recommendation to buy or sell any investments or financial products and services. The author may have positions, either long or short, in some or all investments mentioned in this article. While the information contained is believed to be accurate, neither Rational Banker nor any persons or entities associated with it can be held responsible for any errors. Prior to making any financial decisions, please do your own due diligence and/or speak with a professional to determine the suitability of such decisions.