Bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria – Sir John Templeton

The beauty of investing is that market constituents are not homogenous. In other words, rarely will you find equities or bonds of different companies to be identical in terms of the specific risks and opportunities they represent. Similarly, if an index as a whole appears to be in overbought or oversold territory, not all stocks within that index may be experiencing that same situation. Hence, the need to have a disciplined investing process that one can adhere to within and across market cycles.

Current Market Developments Remind (Seasoned) Investors Of Previous Tech-Driven Enthusiasm

…How do we know when irrational exuberance has unduly escalated asset values…? – Alan Greenspan

Investing is part art and part science – there is a mix of subjectivity and interpretation even when it comes to looking at quantitative information. This is partly why it can be difficult to arrive at a strong consensus on whether a given market is experiencing excesses or not. Ultimately, this drives investors toward their respective positioning. That being said, with the robust equity market performance this year, an argument can be made for some areas of the equity market displaying the same characteristics present during the dot-com bubble.

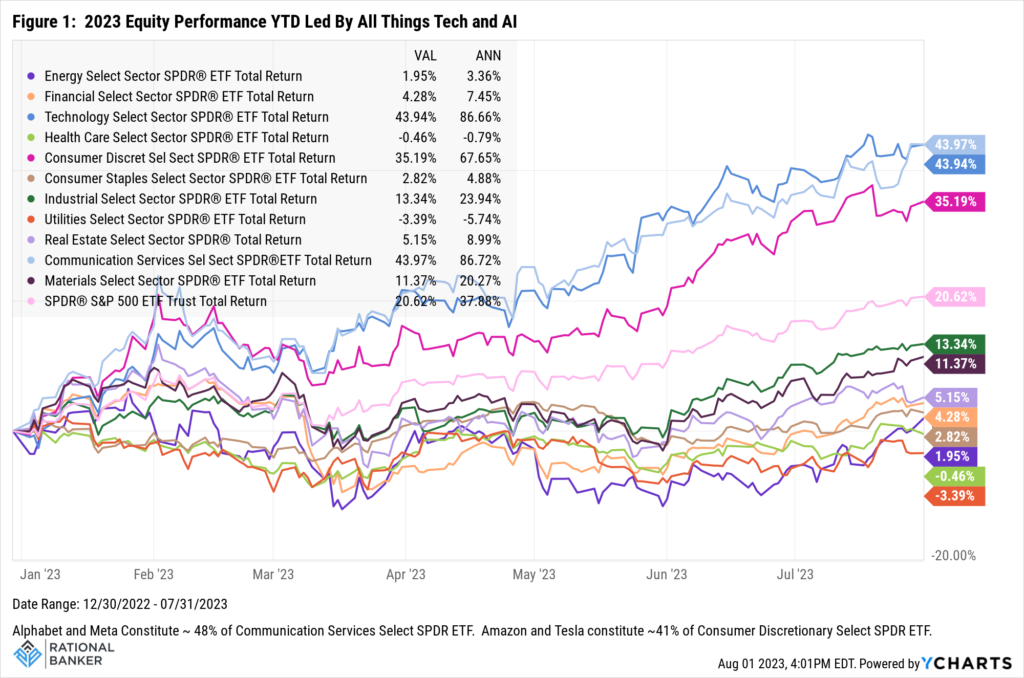

For one, technology-focused stocks, particularly those touted to be drivers or key beneficiaries of AI developments have dominated the current rally (see Figure 1). This is also an extension of the technology and growth-focused theme that has been in play for years (see Figure 2).

While this has broadened out more recently, this narrow market breadth is similar to the bubble driven by technology stocks during the late 1990s and early in 2000. This can be seen in Figure 3 below depicting performance of the technology-heavy Nasdaq Composite Index and the broader S&P 500 Index. Back then, the companies building out Internet and connectivity infrastructure were all the rage. Sometimes, enthusiasm for .com businesses even led to ridiculous justifications for lofty valuations. Previously non-existent metrics (remember eyeballs?) provided a way for investors to explain sky-high valuations for many of those companies despite having no clear path to profitability – ever.

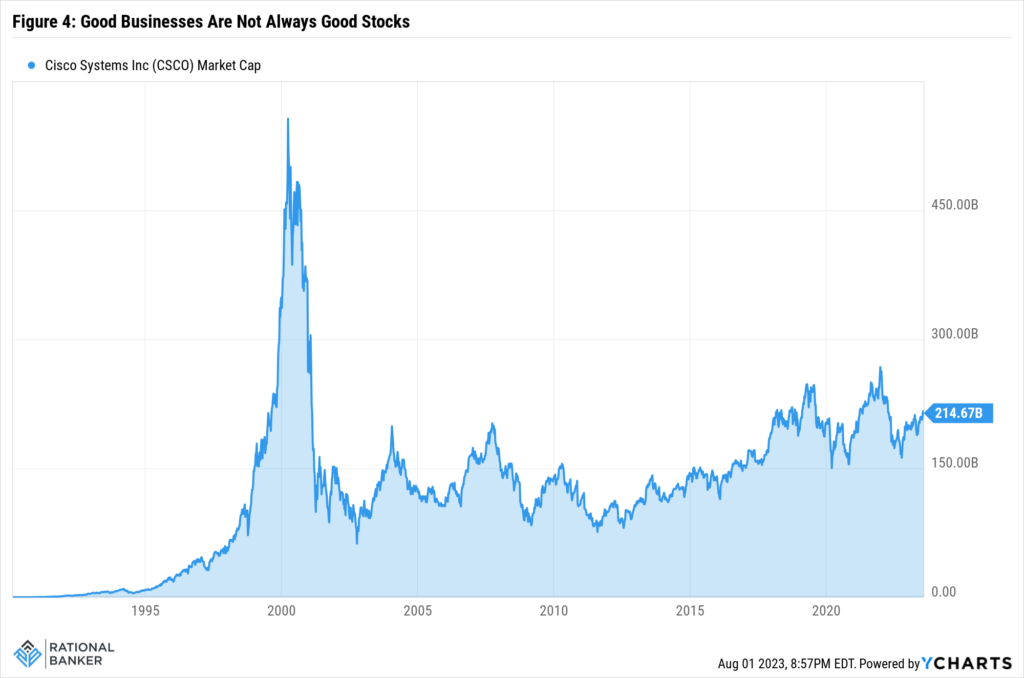

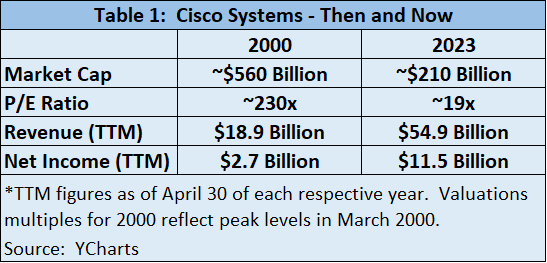

The euphoria for tech stocks in the late ‘90s and early ’00 was not limited to IPOs and companies with limited previous existence as public companies. Even well-established, blue-chip stocks were caught up in the craze associated with the potential for a new digitally connected world and how this would revolutionize how we lived and conducted business. For a look at one tech darling of the 1990s and its peak valuation at the height of that tech bubble compared to now, take a look at Figure 4 below.

Looking at the table above, Cisco Systems today looks like a much more attractive investment that it did back in 2000. The company has three times the revenues, more than four times the profit, and a much more reasonable valuation. To boot, the stock sports a dividend yield of almost 3% today while it didn’t pay a dividend back in 2000. Looking at those valuations from 2000, they clearly reflected expectations of significant, sustainable growth rates going forward. While the company has grown significantly, expectations at the time were still too high for many tech stocks, including established businesses like Cisco that ultimately led to a re-rating. An interesting question to ask today is whether there are any stocks that might have the same degree of optimism (or hype) that Cisco Systems experienced back then?

Another interesting similarity between the dot-com bubble era and today’s technology-led equity strength is the backdrop of interest rates. Then, as now, the Fed was embarking on a series of interest rate hikes that started in June 1999 and ending in May 2000. The Fed raised a total of 175bps within the course of a year. That is not nearly as significant as the speed and magnitude of the current cycle of increases – over 500bps in less than 18 months. However, it still brought the Fed Funds Rate to 6.50%, which was the highest it had been in the previous nine years. Similar to today, investor risk appetite remained resilient during the tightening cycle. Today, central bankers have gone to even greater lengths to communicate more clearly about the possibility that higher interest rates may remain in place for longer if needed to fully quell above-target inflation levels. Still, markets have largely shrugged these statements off while looking beyond the current phase to an era of lower rates.

Past Performance Is Not Indicative Of Future Returns

The Nasdaq Composite, was the go-to market for growth investors by the late ’90s. In fact, from its opening value of 1574 on January 2nd, 1998 the index more than tripled to reach 5048 at its closing peak on March 10th, 2000. This works out to an annualized return of 70% over that period. The performance led to significantly inflated valuations, particularly on technology stocks that drove much of this market bubble. It was the epitome of the phrase irrational exuberance made famous by Alan Greenspan in a speech he gave at the American Enterprise Institute in 1996. The Nasdaq Composite did not close above the 5000 level again until early March of 2015, nearly a full 15 years to the day from the first time it eclipsed that level (see Figure 5).

Stating the obvious, the 10-year period from 1990 through 1999 was a remarkable one for the Nasdaq Composite Index and the broader S&P 500 Index, both driven by the meteoric rise in technology stocks. The following 10-year period was starkly different (see Table 2). It is critical to point out that the latter period was marked by unique events beyond the bursting of the dot-com bubble. It included significant events such as the September 11th attacks, and the global financial crisis. However, it serves as a lesson not to extrapolate past performance (good or bad) into the future.

Better A Skeptic, Or An Optimist?

Whether to look beyond elevated valuations and higher interest rates or consider portfolio shifts based on the current reality is impossible to know certainty. It is possible for growth companies to “grow into” those premium multiples. This would be more likely if interest rates do come down in the near future, helping to sustain higher multiples, and a prolonged slowdown or hard economic landing are avoided. However, it could also be the case that cumulative effects of such a sharp tightening in monetary policy sap economic strength and drive a re-rating of stocks to remove excess optimism priced into their outlooks. Regardless of one’s perspective, as stated earlier, markets are not made of up homogenous constituents. On a relative basis, there are plenty of companies with more reasonable valuations, many offering attractive dividend yields and resilient earnings power over economic cycles. Many of these can be found in different sectors, providing attractive diversification benefits. Alongside attractive yields in investment grade corporate and government bonds, investors do have options available to tactically and strategically position portfolios for varied expectations.

Final Thoughts

Markets are often touted as being efficient pricing mechanisms over the long-term. In the short-term, this is not always the case. Over different market cycles, there are often examples of companies given unreasonably optimistic valuations compared to the elevated risk associated with them or the quality of the underlying business and vice versa. It usually becomes clear with the benefit of hindsight. This is where discipline can provide a leg-up for the discerning investor. By adhering to a comprehensive plan and investment process, short-term anomalies or market volatility can be an investor’s best friend. Euphoria feels great in the moment, but discipline pays off in the end.

Disclaimer: Data sourced from YCharts unless otherwise noted. The above information does not constitute advice, nor is it a recommendation to buy or sell any investments or financial products and services. The author may have positions, either long or short, in some or all investments mentioned in this article. While the information contained is believed to be accurate, neither Rational Banker nor any persons or entities associated with it can be held responsible for any errors. Prior to making any financial decisions, please do your own due diligence and/or speak with a professional to determine the suitability of such decisions.