“In investing, what is comfortable is rarely profitable”

Robert Arnott

While the strong performance of mega-cap tech stocks has kept them in a seemingly permanent spotlight this year, a range of sectors have largely been left in the shadows. Although lackluster performance has not helped their case, the growing divide between the significant gainers and the rest has unearthed some attractive opportunities for the rational investor. Looking at the Financials sector within the S&P/TSX Composite Index – and specifically the large Canadian Banks – the negative sentiment has pressured stock prices to levels that make them appealing from a long-term perspective. That is not to say these stocks are without risk because they most certainly do have risks. However, if taking a long-term perspective, large Canadian banks are pricing much of the risk in at current levels.

Steep Pullbacks Are Often Buying Opportunities

Equity prices can be volatile, that much is not big news. However, when it comes to the major Canadian banks, sharp price declines are not common. Even more so, when these declines occur, they are not often long-term in nature. Figure 1 below shows how far below their previous peaks the current stock prices are in percentage terms. As you can see, with the exception of National Bank, all are off their peaks meaningfully, with four banks off by more than 20% – a level considered to be bear market territory.

The last time we saw such declines was at the onset of the COVID-19 pandemic as mandated shutdowns were taking effect. At that point, it was nearly impossible to gauge to what extent the pandemic would impact the overall economy. Understandably, the economically sensitive banking sector reflected the extreme risk-off sentiment that took hold at the time. By late March 2020, share prices were down significantly from where they were just weeks earlier. With the benefit of hindsight, the pullback proved to be a solid entry point into many of these names. Less than 12 months later, each of the banks had fully recovered to their previous peaks. While many have pulled back many times since then, it was only when inflation become persistently high and interest rates climbed to combat it starting in mid-2022 that another round of sharp sell-offs occurred. While there has been some pick-up from the lowest levels, bank shares largely remain in the doldrums. Not all banks are created equal, and some of them are facing more enduring challenges, reflected in their longer-term share price performance. Again, this is not necessarily the case for all banks and amidst the broader challenging sentiment, this is where a disciplined investor can look for attractive risk-reward trade-offs.

Valuations Attractive, Though Recession Risk Could Add Downside Pressure

While share prices have come off peak levels, valuations remain an important fundamental consideration. On this front, looking at price/earnings (P/E) and price/book ratios (P/B) in Figures 2 and 3 respectively, shares are hovering at multiples that are in-line with their 10-year average or below them.

Along with attractive dividend yields, this can help provide some downside protection if market volatility spikes higher. Should economic data show a more significant slowdown in activity, this can still add additional downside risk from current levels and should certainly be considered. That being said, this is not about looking to time entry and exit points for a short period but looking for opportunities to build exposure with a long-term time horizon.

Twin Benefits of Income and Growth

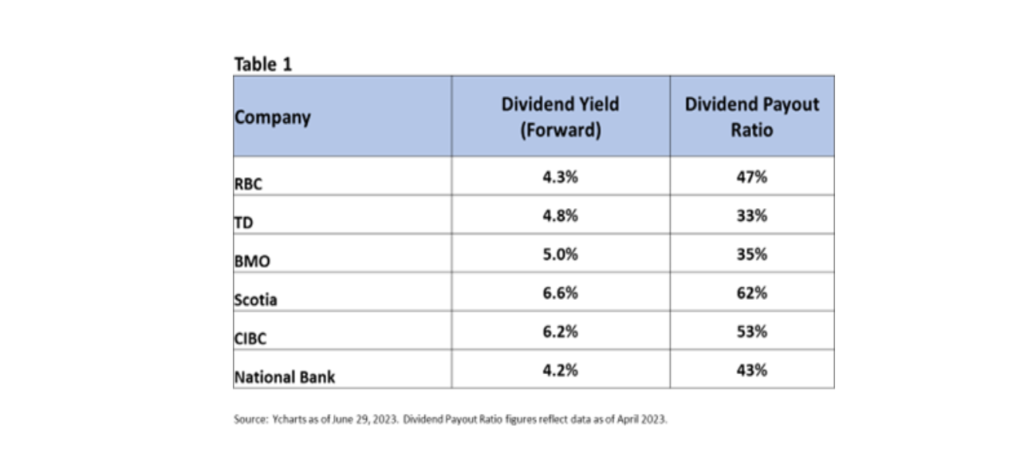

One of the few tangibles in investing is that of income generation. Returns are typically driven by interest or dividend income on one side, and capital gains (or losses) on the other, or a combination of both. Canadian bank stocks have been exemplary in their consistency when it comes to maintaining dividends in good times and bad, and growing their dividend payouts over the long-term in addition to delivering share price appreciation. On the latter point, success has varied depending on the stock and the timeframe. With dividend yields at attractive levels and relatively conservative payout ratios, investors can be paid well to wait out periods of volatility with little risk of dividends being cut or eliminated (see Table 1).

Even Blue-Chip Equities Carry Risks

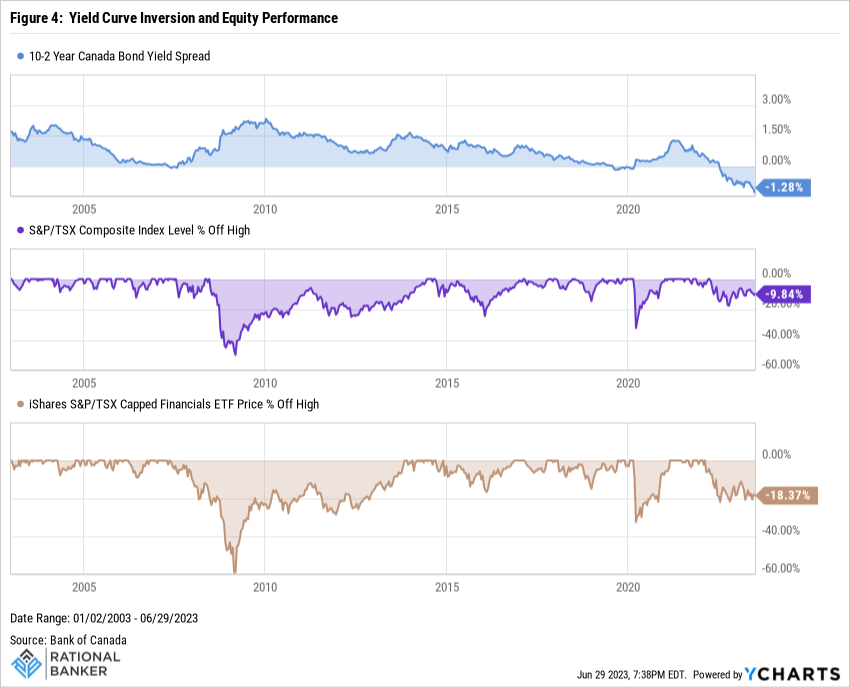

While Canadian Bank stocks have proven resilient over the long-term and deserve consideration as part of a well-diversified portfolio, they are not for the faint-hearted (that goes for equities more broadly as well). There are a number of risks that come with investing in financial stocks, not the least of which is that they are sensitive to the shifts in the economic outlook. Given rising interest rates, elevated debt levels and inflation that remains well-above comfort for the Bank of Canada, it remains to be seen how the economy will transition through this period of complexity. One indicator that has previously served as a cautionary sign is the inversion of the Government of Canada bond yield curve. Figure 4 below shows the degree of inversion, or negative difference between the 10-Year Government of Canada bond yield and the 2-Year Government of Canada bond yield. It is currently at its widest level in 20 years. This has not garnered as much attention during this episode as it has historically, with different justifications being given for this – they sum up to the old, “it’s different this time”. In my opinion, yield curve inversion remains an indicator that is important to pay attention to and the current degree of inversion is concerning. With only two other periods to look at, one can see that those observations preceded recessions. The last recession in 2020 was brought on largely by an unforeseen pandemic that was beyond control and fairly brief in duration. The earlier instance was that of the global financial crisis of 2008/09 and also followed on the heels of a rising rate environment. The two graphics below the yield curve inversion show how the broader S&P/TSX Composite Index and the Financials sector – using the iShares ETF as a proxy – performed over the same period. It’s clear that neither were spared from significant volatility leading up to and during the recession. The Financials sector ETF suffered even more so than the broader index, with a peak-to-trough decline of ~59% on a price-only basis, while the Composite was down about 50% from peak-to-trough. This is to point out that despite the degree of pullback already seen in the large Canadian banks, it could certainly get more challenging if the economic outlook deteriorates considerably from here.

Final Thoughts

Without risk, there is no reward. The key to successful investing is being able to identify opportunities where the degree of risk being undertaken is appropriate relative to the potential return. Canadian banks are facing a range of risks in the current environment, including contending with a slowing economy, rising rates and consumer debt levels, alongside unique risks relative to their own particular operations. However, share prices have to some extent already reflected these concerns, and valuations remain reasonable, and dividend yields provide a healthy income stream to patient investors. There are worse things to do than using pullbacks in Canadian banks stocks to build long-term positions. With high-flying tech stocks garnering the spotlight these days, Canadian banks are among several high-quality businesses across sectors that may be overlooked. Using this to one’s advantage to diversify and add robustness to their portfolio can help reduce downside risk when market volatility spikes. Over the long-term, as markets refocus on fundamentals and the risk-reward relationship, businesses that offer attractive return potential relative to the risk entailed will again demonstrate their merit as part of a well-constructed investment plan.

Disclaimer: Data sourced from YCharts unless otherwise noted. The above information does not constitute advice, nor is it a recommendation to buy or sell any investments or financial products and services. The author may have positions, either long or short, in some or all investments mentioned in this article. While the information contained is believed to be accurate, neither Rational Banker nor any persons or entities associated with it can be held responsible for any errors. Prior to making any financial decisions, please do your own due diligence and/or speak with a professional to determine the suitability of such decisions.