As we put last year’s market performance in the rear view, we can be thankful for a key takeaway. Valuations made a comeback as a key consideration in investing. It would not have been possible without the aid of sharp increases in interest rates over the year, so credit (no pun intended) has to be given on that front. As expectations for a slowing economy took hold, equity valuations turned lower as the outlook for earnings growth became more uncertain.

Long-term investing success depends on the ability to assess the potential risks and rewards of an opportunity, or its risk-reward profile. For stocks, their valuation plays a part in the assessment. High valuations may tilt the profile towards being too risky for the potential rewards and vice versa. It sounds straight forward, but sometimes valuations seem to fall off the radar.

How to think about valuations

There are a few key questions to think about when it comes to valuations that serve as a starting point:

- How does a stock’s valuations look relative to peers and the market currently? How does this compare historically?

- How does a stock’s current valuation measures compare with its historical trends?

- What is the rationale for the answers to the above questions?

They provide a good starting point before looking into additional specifics of the company itself. Regardless of whatever else may be factored into investment decisions, a clear picture of the valuation can help to better gauge a stock’s opportunities and risks.

Below are a couple of examples of stocks that had outsized gains heading into 2022, driving valuations to levels that became hard to justify with even the most optimistic outlook for the businesses themselves. Investors who were caught up in the euphoria of a particular company’s “potential” and overlooked its valuation likely faced a painful wake up call over the past year.

Tesla – Too Much of a Good Thing?

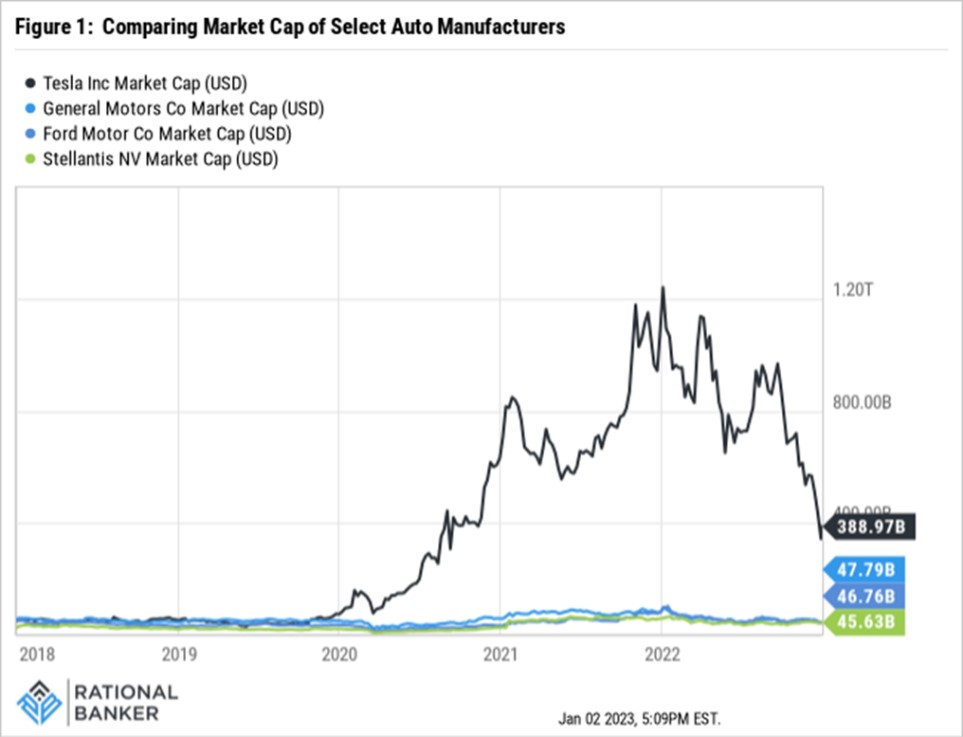

Here is a great example of an innovative business with a strong brand, solid growth, and a dominant player in the electric vehicle (EV) market. However, that positive description does not extend to an assessment of its valuation. Figure 1 below shows how Tesla’s market cap compares to more traditional auto makers rather than direct EV competitors – the reasoning behind this comparison follows below. Table 1 shows the trailing PE Ratio for each of the stocks.

Table 1: Comparing PE Ratios of Select Auto Manufacturers

Stock | PE Ratio (TTM) |

Tesla | 38.1 |

GM | 5.7 |

Ford | 5.2 |

Stellantis | 2.6 |

Source: YCharts. As of Jan. 2, 2023

As can be seen above, Tesla stands out as having become so large in market cap that it actually dwarfed the combined value of GM, Ford and Stellantis (the maker of Jeep, Dodge, and Chrysler vehicles among others). If you threw in behemoth Toyota for good measure, Tesla would still be larger than all of them combined! Tesla’s growth rate has been enviable to say the least – recently reporting 40% growth in deliveries in 2022 compared to the previous year. However, they are growing from what is still a small overall base. Tesla delivered around 1.31 million vehicles in 2022 according to their press release. To compare, GM delivered more than that in the third quarter of 2022 alone based on their earnings release, while each of Ford and Stellantis had more than 1,000,000 vehicles sold on a wholesale basis according to their most recent quarterly releases.

The underlying points here are that while a business may be performing very well and may warrant a premium valuation to reflect consistently solid execution, the question becomes what level of premium is sensible? Looking at the stock’s performance in 2022, it is clear that a combination of factors drove a re-think on this question as the year unfolded.

Shopify – Priced for Perfection?

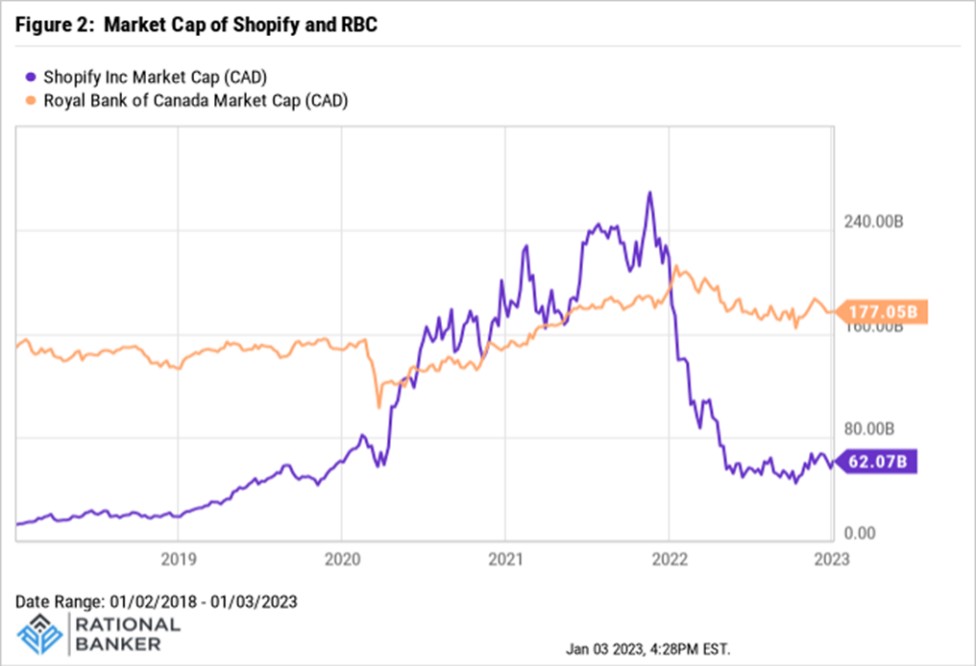

As a Canadian, it is terrific to see a homegrown success story. However, that does not mean we should throw objectivity out the window. Touted as an Amazon rival (another stock that had its valuations overextended), the company had been delivering strong revenue growth. This was accelerated by the move of businesses online due to the heightened covid pandemic restrictions in 2020. Perhaps the only thing that grew faster than Shopify’s topline growth was investor euphoria for its shares. The stock reached such dizzying heights that it became the largest company by market capitalization at one point. That milestone on its own should have served as a warning that its valuation, and other predominantly high-growth technology stocks with similar levels of investor enthusiasm, was simply beyond rational justification. The company was barely earning operating profits when it dwarfed the market value of well-established businesses with a track record of generating substantial annual earnings. Figure 2 shows how the market values of Shopify and RBC, Canada’s largest bank and currently the largest company in Canada by market value, evolved over the past five years.

At the end of 2021, Shopify had a larger market value than RBC. From their earnings release, RBC had net income for 2021 of approximately $16 billion. Shopify had a net operating income (instead of net income to exclude investment gains) of less than $1 billion in the same period. That significant difference in earnings while Shopify was similar to RBC in market value (even larger at some point) should have raised some flags. Regardless of the fact that the growth rate of Shopify is much higher than that of RBC, the fundamental question of “how much future growth should we be paying for today?” should have been asked. While Shopify may be able to grow successfully for a prolonged period, there is no assurance that past performance can be repeated sustainably for many years. Think about it this way; Shopify would need to achieve nearly 50% growth in operating earnings for about 7 years to reach RBC’s net income for 2021. That’s a fairly long time to deliver that kind of growth, especially as their revenues and profits grow larger and it becomes more challenging to sustain. That also assumes no changes in the competitive, regulatory, or economic landscape to name just a few variables.

The Bottom Line

Valuations, business performance and the full picture of a company’s operating environment, are important to monitor. On their own, valuations may not be sufficient to draw conclusions on whether or not the risk-reward profile of a stock is attractive. However, given that investing is part art and part science, a better understanding of available information can help mitigate some of the investment risks. There are likely other factors you may only be able to estimate at best as far as their implications on the overall risk-reward profile. When valuations are out of sync with the norms, further due diligence can help identify whether valuations are giving warning signals or helping to uncover potentially attractive opportunities. While 2022 may not have given us great memories where returns are concerned, it reminded us that valuations still matter when it comes to investing and that is a valuable takeaway.

Disclaimer: The above information does not constitute advice, nor is it a recommendation to buy or sell any investments or financial products and services. The author may have positions, either long or short, on some or all investments mentioned in this article. While the information contained is believed to be accurate, neither Rational Banker nor any persons or entities associated with it can be held responsible for any errors. Prior to making any financial decisions, please do your own due diligence and/or speak with a professional to determine the suitability of such decisions.