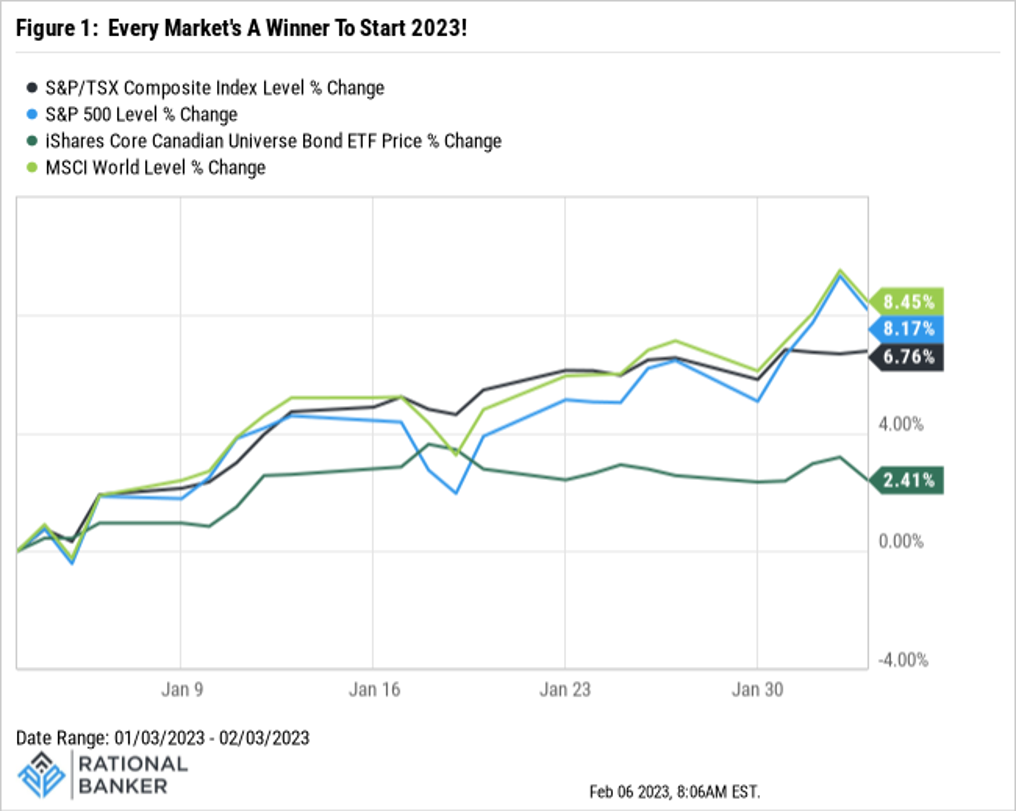

The market rally that began last fall continued into the new year, with January’s performance being nothing short of robust (see Figure 1). An interesting fact, the price gain in the iShares Core Canadian Universe Bond ETF on a year-to-date basis works out to nearly 50% of the total return on that ETF on a five-year basis – pretty crazy, right? In fairness, the reversal of the long-term trend in declining bond yields has meant a difficult couple of years of fixed income performance. While the rally that began last fall may have left a warm winter glow for investors, it is worth highlighting a few realities and keeping our expectations in check as the year unfolds.

A rally on better-than-feared data…

Much of the optimistic sentiment driving equities higher has been centered around shifts in economic trends and expectations. Inflation has eased from its sharp upward trajectory that began in 2021, in turn shifting expectations that the Fed’s rate hikes are already working and could lead to a pause in hikes sooner than later. Job growth continues, but wage growth eased recently (though still strong), providing hope that the labour market is not overly tight. Earnings season is in full swing. While high profile names that have reported to this point have released mixed results and outlooks, it was not enough to have investors concerned about a pending economic downturn.

The bottom line is, overall, the market may have overpriced a downside scenario and now showing signs of relief that a soft landing is a higher probability.

…Is Not The Same As An All-Clear Signal

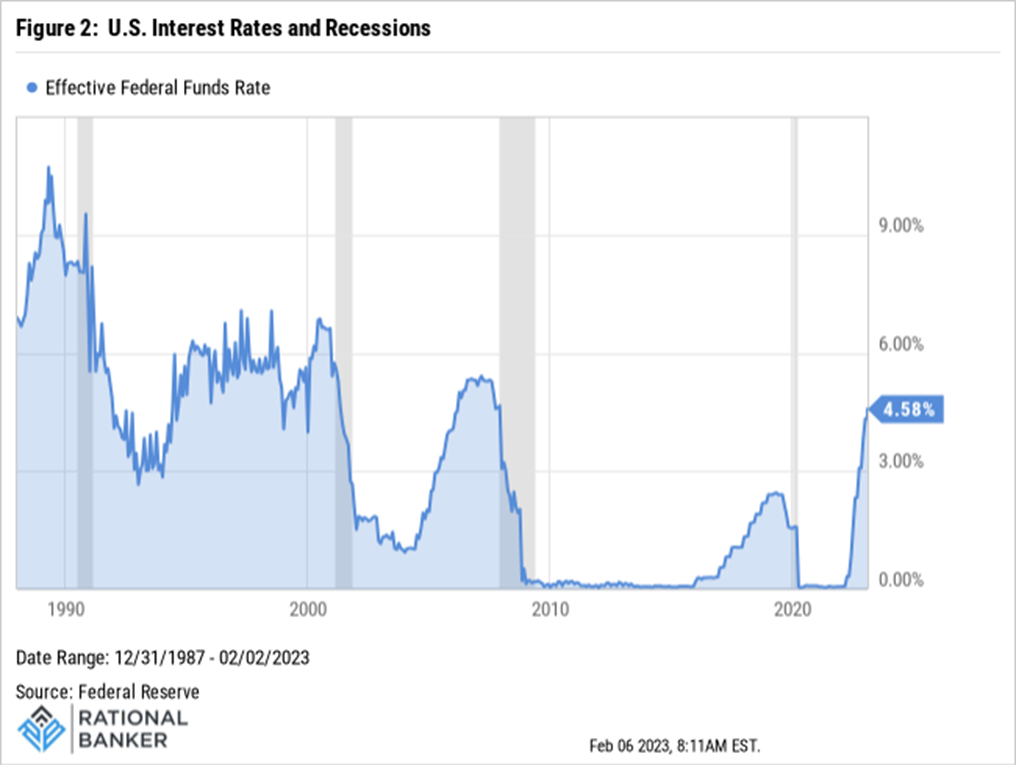

While there has definitely been an improvement in sentiment, it is worth noting that many of the challenges markets have been contending with have not dissipated. The Fed continues to deal with unacceptably high inflation, and there is a lag between each move higher in rates and its impact on the economy. In fact, looking historically, recessions typically begin after interest rates peak (see Figure 2). Given that rates are expected to move higher from here, uncertainty remains when it comes to the cumulative impact of rate hikes on the economic outlook. The unemployment rate in the U.S. hit a 53-year low in January of 3.4%. Those two issues alone are worthy of a reality check for those thinking that nothing but smooth sailing lies ahead.

Geopolitical tensions continue to be a factor, and the war in Ukraine is still raging with no end in sight. Furthermore, after tightening for much of 2022, financial conditions have been easing since October (see Figure 3). This may sound good on the surface, but it is not likely a trend the Fed will want to see continuing. This is especially so given they are taking concerted efforts to reign in liquidity with tighter monetary policy at a time when inflation is stubbornly high.

Simplifying the broader picture, the economy is expected to slow markedly – or potentially enter a recession – later this year. Earnings expectations may need to be revised to the downside and thus increase the risk of market volatility.

So, there are positive signs but also some key issues to contend with – what is an investor to do? Fortunately, when asset prices are rising, it can be easier to conduct due diligence and act on it if needed.

Reassess From A Position Of Strength

“You don’t find out who’s been swimming naked until the tide goes out” – Warren Buffett

Market rallies can sometimes mask stocks or sectors that have weaker underlying fundamentals from those that are stronger. Over time, the asset mix of a portfolio or the underlying components may no longer reflect what was intended or current circumstances. Sometimes, sheer luck can mean having exposure to something that wasn’t suitable, but happens to have given a boost to the overall performance of a portfolio, and sometimes the wrong asset ends up dragging the overall performance down with it. The ideal situation is to avoid having portfolio exposure to investments that shouldn’t be there to avoid unnecessary complications, especially during a challenging market environment.

With the current upswing, use this period of strength to objectively evaluate your investment plan. Are there gaps or deficiencies – such as lower quality positions, too much exposure to a given sector, or a deviation in the asset mix relative to target? With a rise in values, luck may have given an opportunity to correct any shortcomings from a better financial position, so use this rally wisely.

A Contrarian Stance Can Be Beneficial

Popular opinion can be a powerful force to counteract, even for those with strong convictions. While it can be uncomfortable to go against the crowd, if it means adhering to your investment strategy it may just be the best course of action. With the broad narrative driving the current rally focusing on a better-than-feared outlook, the risk of equity prices getting ahead of themselves also increases. As expectations become unsustainable, so does the risk of a spike in market volatility in the event that future economic datapoints disappoint investors. By focusing on the factors an investor is more certain of or can control, such as their investing time horizon, risk appetite, goals, and asset allocation, they can better navigate through market cycles with a view to achieving desired long-term outcomes.

Final Thoughts

The strong start for asset prices in 2023, particularly equities, has been welcome after a challenging 2022. However, the year is young and it is hard to argue that there is a high degree of visibility as far as the economic outlook is concerned. Recognizing that challenges remain can help maintain a disciplined approach to avoid reaching for excess risk relative to one’s ability and willingness to handle it. Periods of market volatility – both upswings and downturns – should not be wasted. Rather, use them to determine if there are rational arguments for any portfolio changes. This should be done by taking into account one’s unique circumstances and long-term goals, not speculating on short-term market performance. If making changes are hard to justify in that context, then the best decision may be to avoid making a change for change’s sake.

Disclaimer: Data sourced from YCharts unless otherwise noted. The above information does not constitute advice, nor is it a recommendation to buy or sell any investments or financial products and services. The author may have positions, either long or short, in some or all investments mentioned in this article. While the information contained is believed to be accurate, neither Rational Banker nor any persons or entities associated with it can be held responsible for any errors. Prior to making any financial decisions, please do your own due diligence and/or speak with a professional to determine the suitability of such decisions.