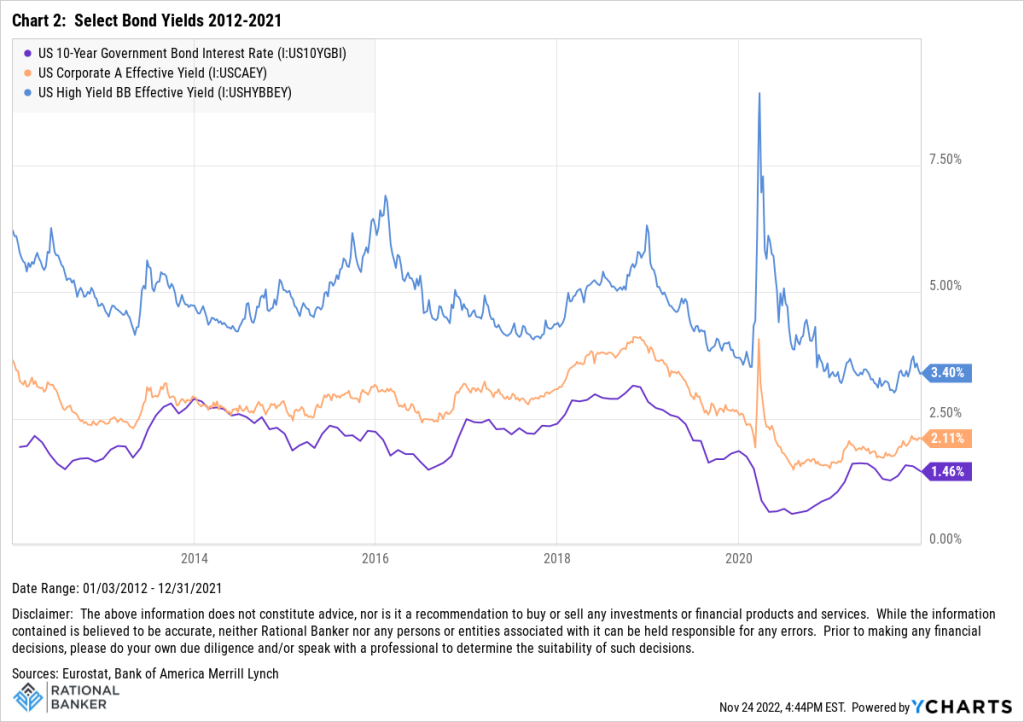

For what feels like an eternity, and certainly any time since the global financial crisis of

2008-2009, it has been a very challenging time for fixed income investors to generate much

“income” from their fixed income investments. This is particularly the case for those looking

for higher quality, lower risk fixed income investments such as investment grade corporate

bonds, government bonds, and guaranteed investment certificates (GICs).

High inflation levels are never welcome, but there are silver linings

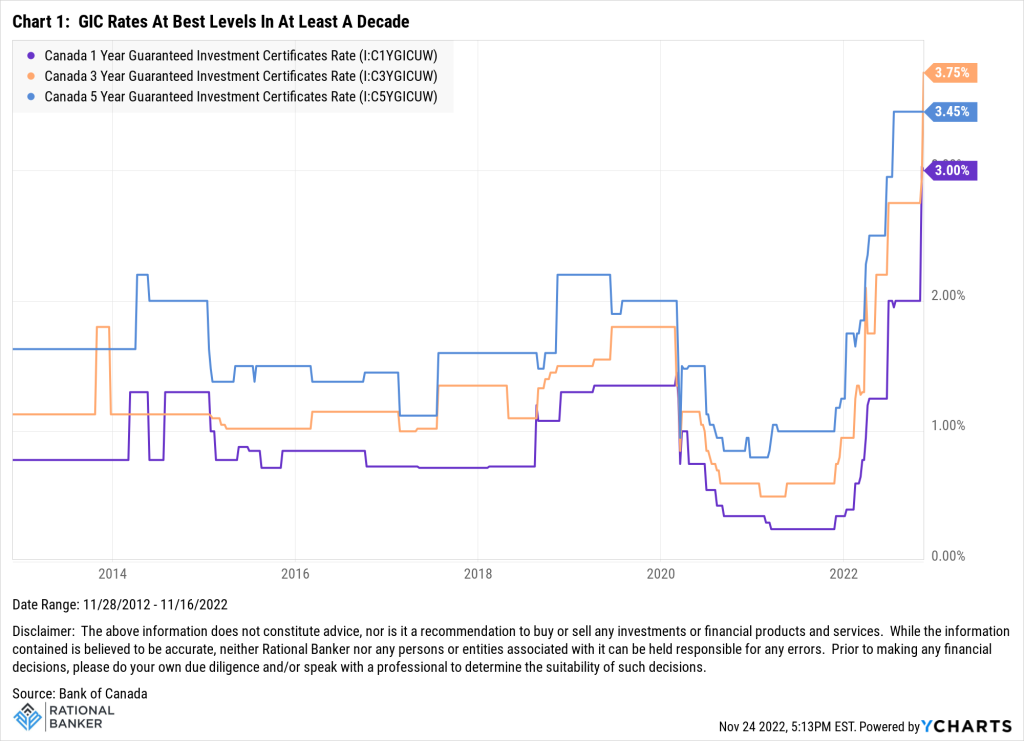

With the Bank of Canada taking aggressive steps to combat rising inflation (similarly to other

central banks around the world), one side benefit to the rising cost of borrowing has been a rise in bond yields and interest rates available for savers and investors (see Chart 1).

An opportunity to capitalize on current market dynamics

- Yields are well-above average levels seen over the past decade

- To dampen potential volatility from risk assets such as equities

- Asset class diversification is at the foundation of portfolio construction regardless of current market dynamics

No strategy is without its risks

As with any investment decision, there are always risks. For instance, if interest rates rise significantly from current levels, bond yields would likely move higher and put downward pressure on bond prices (bond prices move in opposite direction to yields). Additionally, if the economic outlook improves and inflation eases, risk appetite for equities could improve and drive stronger relative outperformance against bonds. A higher exposure to fixed income could mean missing out on additional upside potential you would have had with more equity or other risk assets in your portfolio. There are always trade-offs between risk and returns in portfolio decisions. Ultimately, making decisions based on your specific circumstances, long-term goals and risk tolerance should be the driving force in arriving at those decisions.

Disclaimer: The above information does not constitute advice, nor is it a recommendation to buy or sell any investments or financial products and services. While the information contained is believed to be accurate, neither Rational Banker nor any persons or entities associated with it can be held responsible for any errors. Prior to making any financial decisions, please do your own due diligence and/or speak with a professional to determine the suitability of such decisions