After an unexpectedly strong market performance in January, market sentiment refocused on the backdrop of tightening monetary policy and its economic implications in February. Then in March, a crisis of confidence in the health of the US banking system added a new concern to the cloudy economic outlook. In capital markets perspective can shift rapidly from the glass being half-full to half-empty. The reality is that current market volatility stems from challenges that have been manifesting for some time rather than an overnight development. Interest rates have gone up because inflation has remained a headwind that policy makers are squarely focused on getting under control. It has moderated from peak levels but still has a way to go before reaching a point that can satisfy their concerns. Current banking distress may help accelerate this process if it leads to tighter financial conditions (see Figure 1).

Employment remains strong and asset prices have remained relatively resilient, albeit with increased volatility. The degree of resilience should have been suspect given the logical expectation that headwinds from rising rates should weigh negatively on both of those fronts.

Why The Sudden Dour Mood?

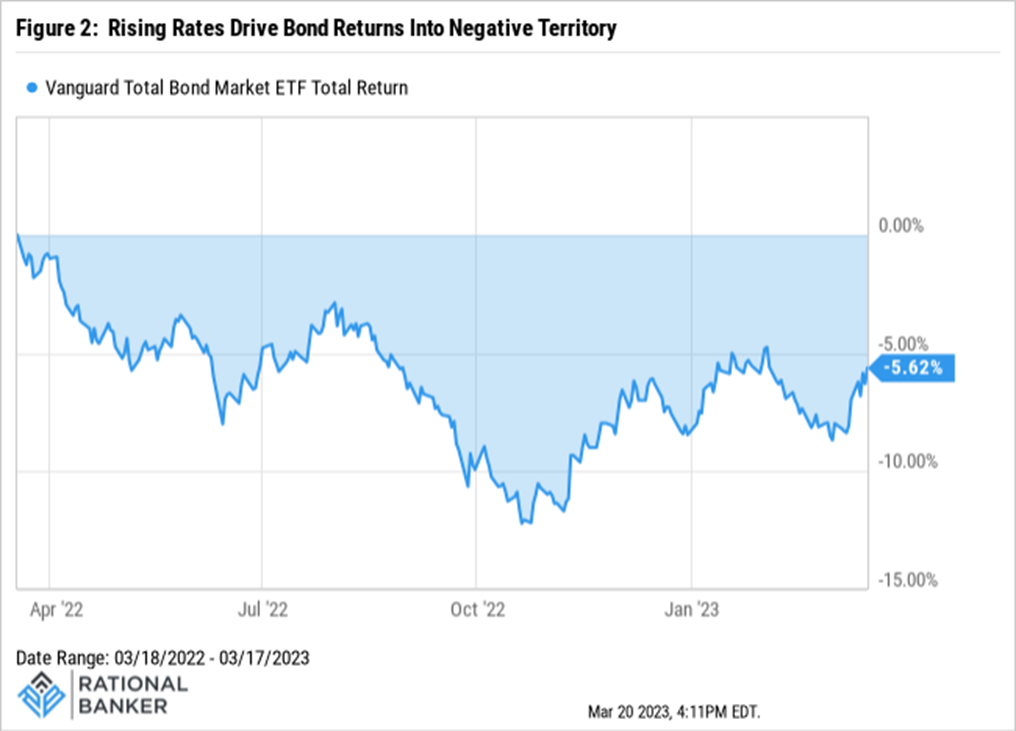

If it was not already clear, two words…interest rates. As it relates to the banking sector in the US, rising interest rates were already wreaking havoc on balance sheets, particularly smaller regional banks. Their bond holdings were declining in value as yields were rising amidst the sharp increase in interest rates (see Figure 2).

Silicon Valley Bank (SVB) was the highest profile victim of this situation, with the added combination of clients withdrawing deposits and the inability to raise capital leading to its spectacular failure. Worries about losses at Signature Bank also led to regulators seizing control and effectively shuttering their operations. Just this past weekend it was the European banking sector’s turn for a rescue. The Swiss government supported the acquisition of Credit Suisse by UBS after a liquidity lifeline proved insufficient to allay concerns about the company’s viability. Fears of contagion and a possible domino effect have driven many banking stocks, particularly regionally-focused ones, to multi-year lows. The volatility drove inflows into safe haven assets, particularly government bonds, driving yields lower across the curve. Interest rates were already starting to have an impact in some parts of the economy, sure – real estate being one of them, with rising borrowing costs crimping the spending power and credit availability for buyers and existing homeowners. However, the full effects have not yet been felt across the broad economic spectrum. Unless the Fed does a complete u-turn (and more financial stress would be needed to justify this move), rates are likely to remain elevated for the time-being and continue to slow inflation and economic growth.

Why Does The Banking Sector Matter So Much?

A healthy banking sector plays a significant role in underpinning economic growth. Banks are key intermediaries in free-market systems, serving as conduits between suppliers and users of capital. Confidence is the foundation that underpins a functioning banking sector. Over the past few weeks, as concerns over the financial health of several banks grew, the extreme effects of a loss of confidence came to light. Customers rushed to pull their deposits from “weak” banks (weakness being either real or perceived). SVB collapsed under this pressure, and the risks of broader disruption to the financial system spurred regulators to take significant measures. Confidence clearly needs to be restored and the extreme developments unfolding in real time reflect the urgency of the situation.

Banks May Need To Get Back To Being Boring, Stable Businesses

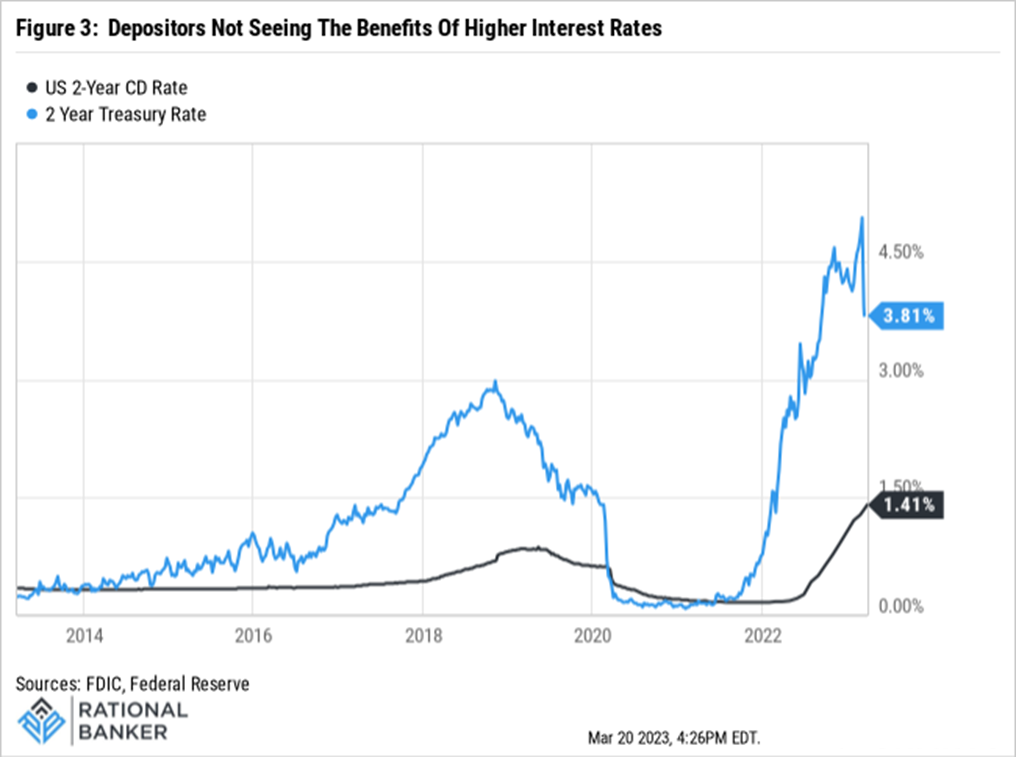

Rising interest rates may have wreaked some havoc on bank balance sheets due to quickly changing bond prices. However, rising rates did not force banks to put large amounts of excess capital into longer term bonds, they simply exposed the flaws of this strategy. Less-than-robust risk management practices allowed senior leaders at affected banks to make these decisions. Bond prices typically have an inverse relationship with interest rates, so as interest rates have been rising, bond prices declined, leading to losses at banks with large exposure to bonds on their balance sheet. Unless bankers were completely asleep at the wheel, they should have seen this scenario unfolding some time ago. The Fed has been messaging clearly and consistently over the past year about the need to stay the course on rising interest rates. Why not reposition and leave much more of this capital in much more shorter duration assets to reflect this clear messaging? Ultimately as banks disclosed those losses, it accelerated the run on those banks as customers withdrew deposits due to worries about their solvency. The other dimension to recognize here is an element of greed. Banks undertaking these practices were at least in part looking to maximize the profit spread they were earning on the returns of those bonds while paying much lower rates their customers’ deposits. Looking at Figure 3 below, you can see the spread between 2-year Certificates of Deposit (CDs), and 2-year Treasury yields as an example.

Perhaps stronger risk management combined with striking a more balanced approach between profits and providing added value to the customers that drive those profits would facilitate more resilient business models for banks. This may mean sacrificing outsized profits in good times. However, it may also mean avoiding losses such as the ones being incurred on the investment portfolios of several of the affected banks. Meanwhile, the value-add of providing better rates to customers on their deposits might drive higher loyalty over time that that could limit how many of them flee from those very banks at the first sign of concern.

Opportunity Lurks Amidst Risks

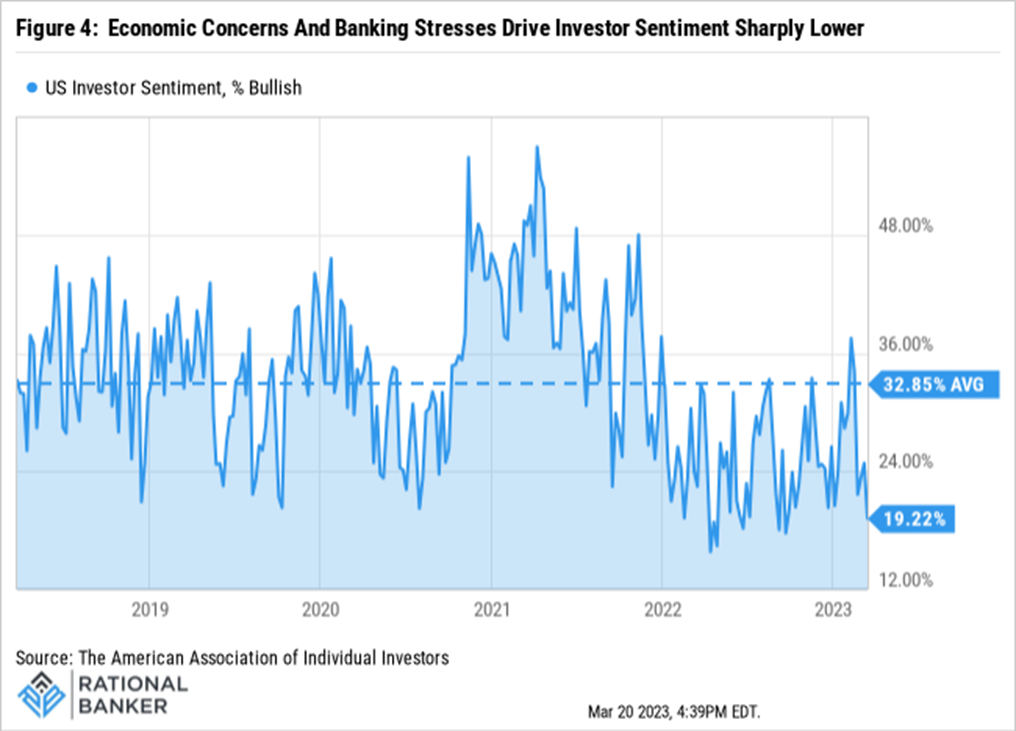

It is often said that success partly consists of luck and timing. Current circumstances provide long-term investors with the ability to use timing to their advantage. Risks to the economic outlook remain. Many risks are known while others are yet unknown at this point in the cycle. However, market sentiment may have overshot to the downside in some sectors in the short-term (see Figure 4). This is particularly the case for shares of high-quality businesses with solid balance sheets, attractive valuations and the resilience to withstand temporary disruption. Add to this, yields within the fixed income landscape remain better than in many years past, allowing for income-oriented investors to gain access to quality bonds that actually provide reasonable total returns! If one can stomach the daily ups and downs there are definitely opportunities to be captured by taking a contrarian approach in the current risk-off environment (see Figure 4). By sticking with a disciplined, balanced strategy, investors can realistically generate a combination of income, growth potential and reduced risks through diversification more effectively today than even a year ago.

Final Thoughts

No one relishes the idea of losing money on their investments, but it is part of the investing process. Most successful investors would not have attained success without incurring losses along the way. From my view, losses (and the risk of losses) are a very needed element in the cycle. This is particularly the case when excessive risk-taking becomes widespread, and complacency compounds the underlying risks. In such situations, volatile markets serve to do two things. First, they act as a reminder for those participating in excessive risk-taking of the financial and non-financial consequences. Second, volatile markets present opportunities for disciplined investors. The latter group can take advantage of the uncertainty by investing in high-quality businesses where valuations may be unreasonably discounted alongside their lower-quality counterparts. While disciplined investors may miss out on taking some of the speculative bets that can lead to quick profits, their odds of success are definitely better over time…and investing is a marathon, not a sprint.

Disclaimer: Data sourced from YCharts unless otherwise noted. The above information does not constitute advice, nor is it a recommendation to buy or sell any investments or financial products and services. The author may have positions, either long or short, in some or all investments mentioned in this article. While the information contained is believed to be accurate, neither Rational Banker nor any persons or entities associated with it can be held responsible for any errors. Prior to making any financial decisions, please do your own due diligence and/or speak with a professional to determine the suitability of such decisions.