“If investing is entertaining, if you’re having fun, you’re probably not making any money. Good investing is boring”

– George Soros

Dividends are a significant portion of total equity returns over time

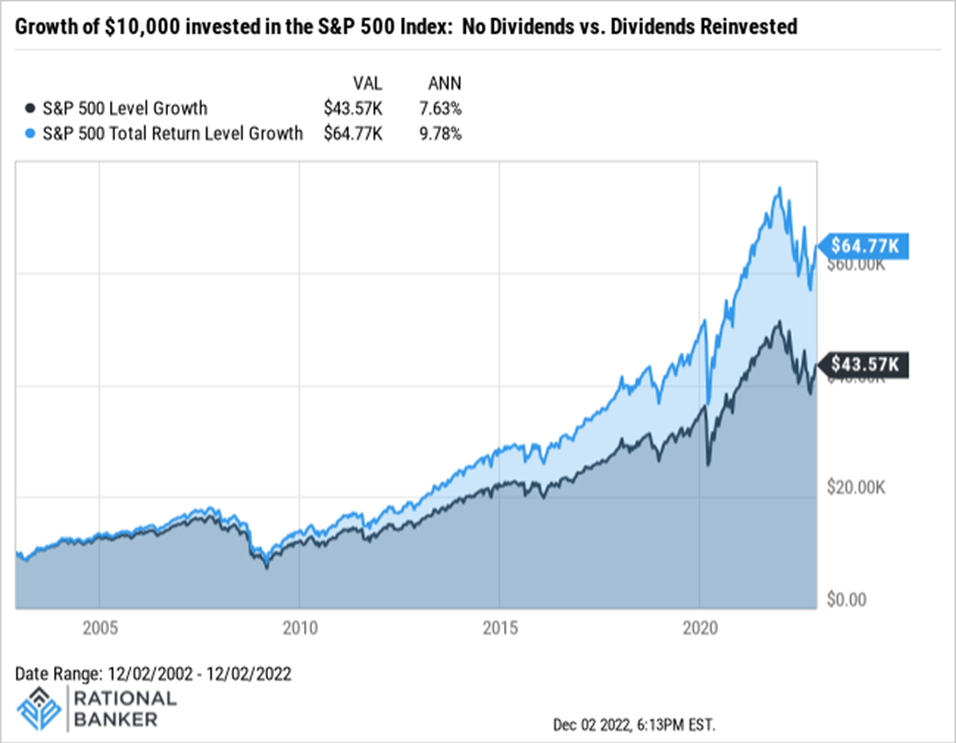

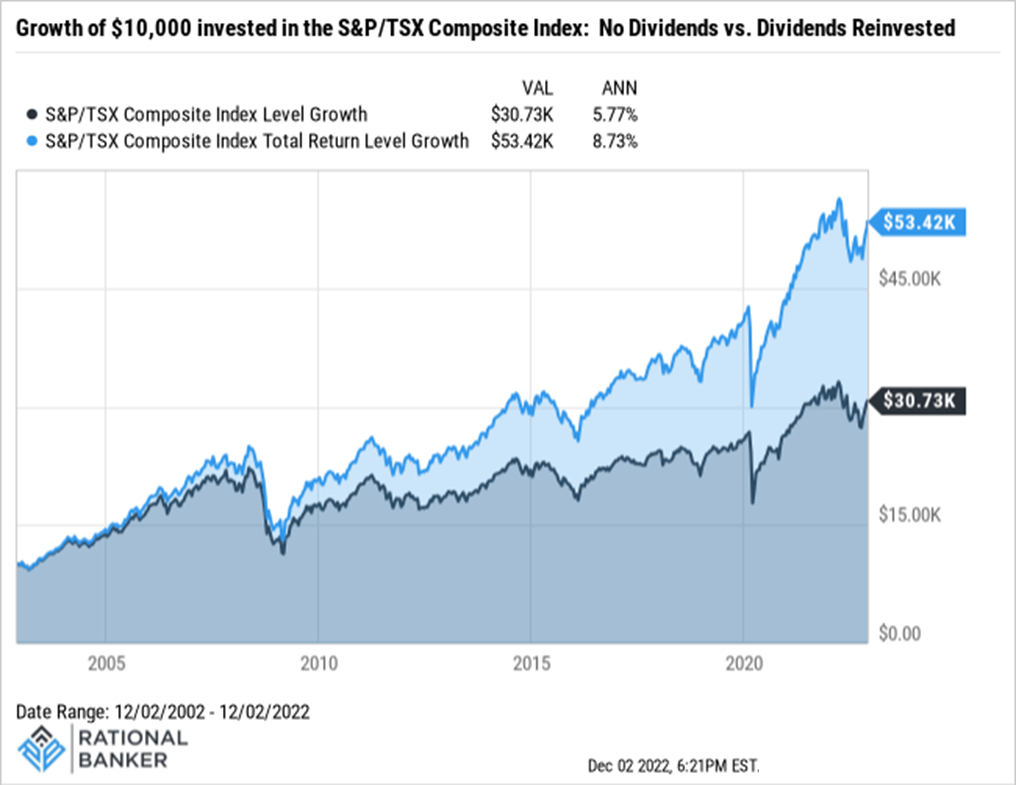

This is a pretty important fact – ultimately, if you are investing in equities, you are looking to generate returns over the long-term. So, logic would have it that anything that contributes positively to this outcome is welcome. One cannot ignore the value that reinvested dividends constitute of the big picture. A picture is worth a thousand words, so take a look at Figures 1 and 2 for a visualization that shows how much a $10,000 investment would be worth in each of the S&P 500 Index and S&P/TSX Composite Index on price-only and total return bases, respectively.

The results are quite compelling:

S&P 500 Index:

- $10,000 invested over 20 years excluding dividends grows to roughly $43,600.

- $10,000 invested over 20 years including reinvested dividends grows to roughly $64,800.

The result is a nearly 50% higher result including dividends, without any change to the underlying assets.

S&P/TSX Composite Index:

- $10,000 invested over 20 years excluding dividends grows to roughly $30,700.

- $10,000 invested over 20 years including reinvested dividends grows to roughly $53,400.

The result is even more significant for the Canadian equity market, nearly 70% more when including reinvested dividends in your investment.

Figure 1

Figure 2

Dividends are a sign of confidence in the outlook

Dividends provide shareholders with great optionality

Investors have choices when it comes to the dividends they receive. They can reinvest them to buy more shares in the stock, they can collect dividends on different investments and use them to make new investments, or simply use the cash for personal needs. They are more than “paper profits” and so being able to have a tangible portion of your investment return can serve as an added peace of mind, particularly in times of market turbulence.

Dividends tend to be more resilient than stock prices during market volatility

Following on an earlier point, while dividends are not guaranteed, they are made with intentions not to reverse course at every sign of uncertainty. Looking at Figure 3, during periods of significant market turmoil over the past three decades, the relative drop in dividend levels of the broader market have been much less. The main exception being during the global financial crisis (GFC) of ’08-’09, where the trailing twelve-month dividend level dropped about 24% from its previous peak. This was significant, but keep in mind the serious risks to the financial system, with banks and investment banks failing altogether and many others scrapping their dividends entirely. As large a drop in the dividend level as it was, it was much less than the more than 50% drop in the S&P 500 Index at the time from its previous peak. As you can see, many periods of market volatility, including the pandemic, were met with much more muted reactions in the dividend level. This resiliency can also be a source of comfort when there may be little to find during turbulent times, and help mitigate some of the downside impact.

Figure 3

Final Thoughts

There are merits to diversification when it comes to different investing styles. With growth-oriented investing having dominated much of the past decade through to the pandemic, dividend investing took a back seat. As market volatility resurfaced over the past year particularly, dividend-paying stocks with attractive relative valuations, robust balance sheets and strong earnings track records once again garnered more interest. The points made in this article represent a few more broadly supportive arguments in favour of dividend investing, but are not comprehensive. Any strategy has its limitations as well, always be sure to consider different investment approaches in the context of your own circumstances, risk tolerance and long-term goals before assessing their suitability as part of your investment plan.

Disclaimer: The above information does not constitute advice, nor is it a recommendation to buy or sell any investments or financial products and services. While the information contained is believed to be accurate, neither Rational Banker nor any persons or entities associated with it can be held responsible for any errors. Prior to making any financial decisions, please do your own due diligence and/or speak with a professional to determine the suitability of such decisions.