Global economic growth is facing headwinds. The conflict in Ukraine, persistent global inflationary pressures, and rising interest rates are some of the key challenges clouding the economic outlook. However, when you take a look at the global landscape, risks and opportunities differ across regions. That presents investors with the ability to better diversity portfolios. Think about it this way, by taking a global approach to investment strategy there is a better chance to capture the unique opportunities that exist in different parts of the world. Doing so also means spreading your risks more broadly. That is a rational strategy in any environment, and even more so amidst uncertainty.

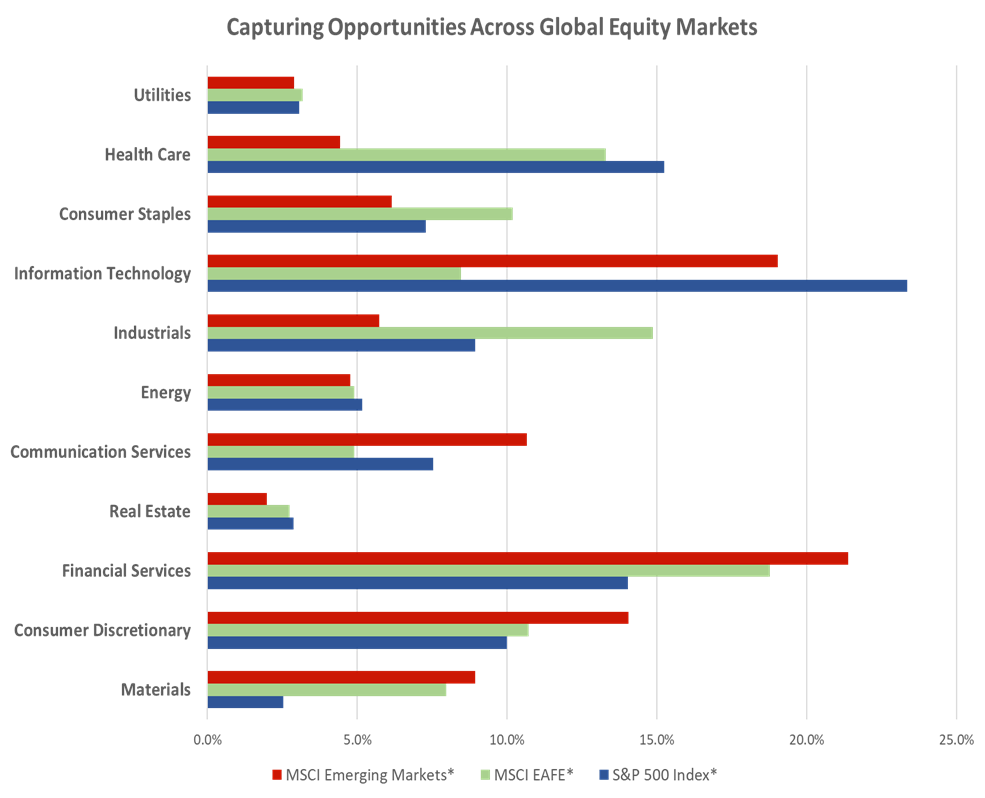

The chart below shows that not all equity markets are the same in terms of their sector mix. Furthermore, best-of-breed companies or emerging leaders are often spread across different markets.

Source: YCharts. *ETF data used as proxies for benchmarks. MSCI Emerging Markets Index represented by iShares MSCI Emerging Markets ETF. MSCI EAFE Index represented by iShares MSCI EAFE ETF. S&P 500 Index Represented by iShares Core S&P 500 ETF. iShares MSCI Emerging Markets ETF data as of January 13, 2023. iShares MSCI EAFE ETF data as of January 17, 2023. iShares Core S&P 500 ETF data as of January 18, 2023.

North America – Impossible to ignore

With the U.S. equity market being the world’s largest, it is hard to imagine completely excluding it from a well-balanced portfolio. As a Canadian, U.S markets help round out areas where our own markets are under-represented. Many of the notable and innovative tech giants are listed and domiciled here, alongside a range of businesses across sectors that are important to have exposure to for broad diversification, such as those in the Consumer and Health Care sectors. The outsized performance of U.S. equities over the past decade, led by technology stocks, has contributed to higher valuations in this part of the global equity landscape. While still important to maintain exposure, it helps make the argument for not putting too many eggs in this one equity basket.

Canada is a more narrowly concentrated market but offers leverage to global economic growth thanks to higher exposure to the Energy and Materials sectors. Those sectors can be particularly attractive when emerging markets growth picks up. The Canadian market also offers attractive dividend yielding equities is sectors such as Financial, Communications Services and Utilities. This can provide the potential for enhanced long-term total returns but also some downside cushioning during periods of elevated market volatility.

Global Developed Markets excluding USA and Canada (EAFE) – Look past the headlines

It can be easy to look at the headlines in regions such as Europe and feel that the difficulties facing some parts of the world are simply not worth investing. The severe impacts of the Ukraine conflict, for example, can leave many to wonder how long it will be before things “normalize”. When looking at the situation from an investing standpoint, a key distinction is worth noting. Many European businesses in a wide range of sectors from Consumer Discretionary to Health Care to Industrials are global in terms of where they operate and generate their profit.

Despite sluggish growth in some developed economies, many companies within these markets have benefitted from global demand for their goods and services. Think about the rise in demand for international brands alongside the growth of the middle class in emerging markets. In the first nine months of 2022, BMW delivered nearly a third of all its vehicles to mainland China and more than 60% of its vehicles outside of Europe according to its most recent report. LVMH, which owns Louis Vuitton, Tiffany & Co. and many other high-end brands, generates over 30% of sales in Asia (excluding Japan) and over 75% of sales outside of Europe based on its Q3/2022 Revenue report. Japan’s Toyota, Sony and Nintendo are just a few examples of multinationals benefitting from global demand for their products and services. Many more global businesses in developed markets offer additional equity diversification potential.

Again, different developed markets provide their own unique opportunities and risks. On a relative basis, some of them have valuations that look more attractive than the U.S. market, often with higher dividend yields. For a long-term investor, these attributes may make looking past day-to-day headlines or sentiment worthwhile when assessing investment strategies.

Emerging Markets – It comes down to risk appetite

Often the growth engine within the global economy, many of these economies are investing or need to invest significantly to build out the infrastructure necessary to modernize and increase competitiveness. While multinationals from developed markets benefit from these trends, there may be companies based in these local markets that offer more focused exposure and potentially compelling risk-reward profiles.

Sentiment has certainly improved toward emerging markets of late. In particular, China’s moves to reopen and shift away from Covid lockdowns bodes well for a recovery in economic growth. Despite the higher risk associated with emerging markets equities, many of these markets are likely to benefit from secular growth potential that is relatively unique to their circumstances. Looking at relative valuations, on the whole, emerging markets are reasonable compared to developed markets.

Exposure to emerging markets is not for the faint of heart, especially given their more volatile behaviour. However, for long-term investors looking for enhanced growth potential, having a slice of their portfolio exposed to emerging markets may be worth the added risk.

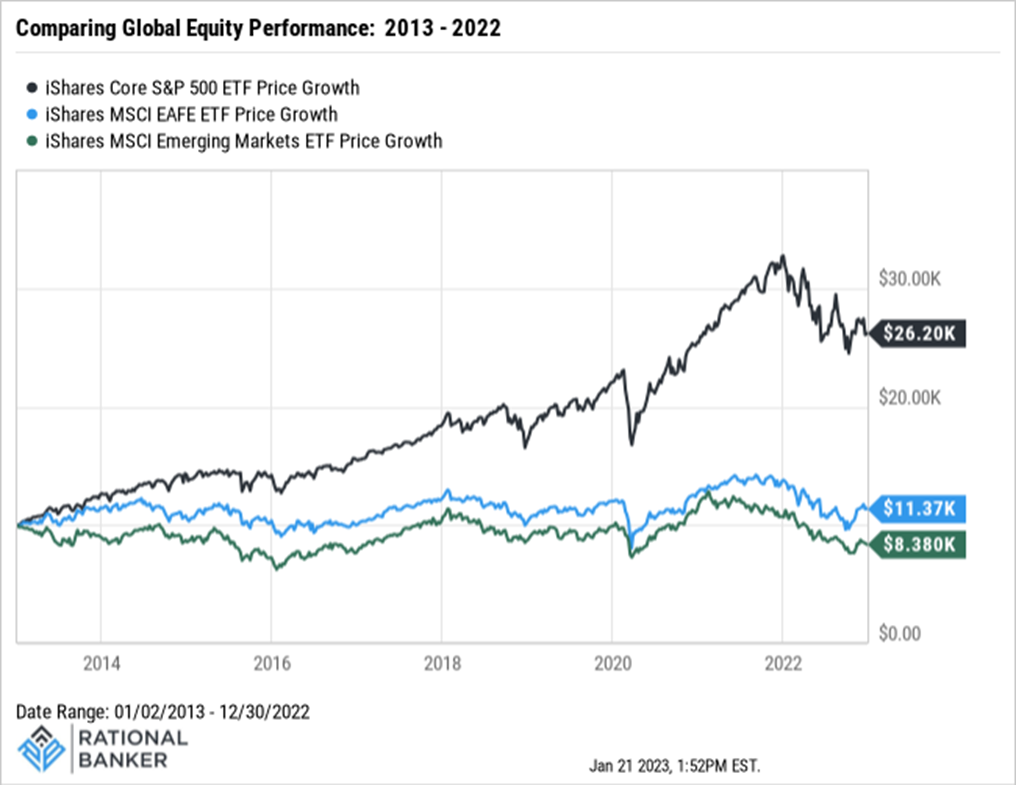

Resist the temptation to let past performance drive your investing strategy

Looking at the past ten years of equity performance, it can become very easy to draw conclusions about where to invest. As is often stated, past performance is not a guarantee of the future. The two figures below show the difference results when investing $10,000 across the three ETFs highlighted in two different ten-year periods to underscore this point.

Final Thoughts

Investing is like a marathon. Success means attaining financial peace of mind, but one has to endure the inevitable market setbacks along the way. With that in mind, investing can be done prudently. A global diversification strategy can increase the odds of achieving long-term goals. Spreading risks across markets and capturing a wider range of opportunities in the global equity landscape can provide a balance between risk and reward within your portfolio.

Disclaimer: The above information does not constitute advice, nor is it a recommendation to buy or sell any investments or financial products and services. The author may have positions, either long or short, on some or all investments mentioned in this article. While the information contained is believed to be accurate, neither Rational Banker nor any persons or entities associated with it can be held responsible for any errors. Prior to making any financial decisions, please do your own due diligence and/or speak with a professional to determine the suitability of such decisions.