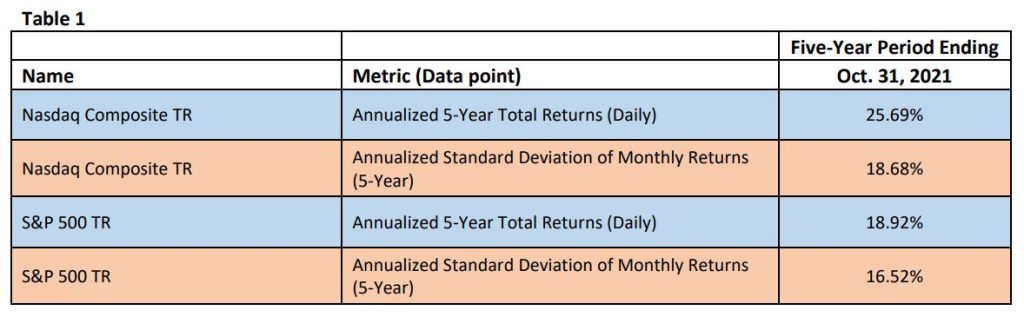

First Scenario: Looking at historical risk and return data of U.S. equities to make an investment decision

TR = Total Return

Source: YCharts. Data as of November 28, 2022

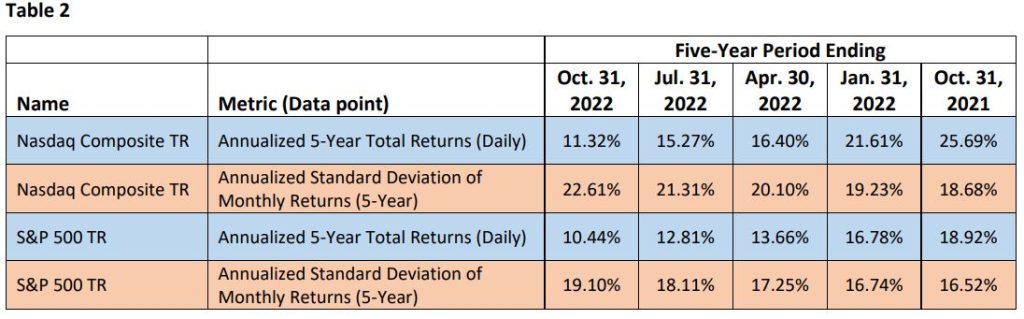

TR = Total Return

Source: YCharts. Data as of November 28, 2022

What is the significance?

Second Scenario: Reviewing performance of equities and bonds to establish asset mix

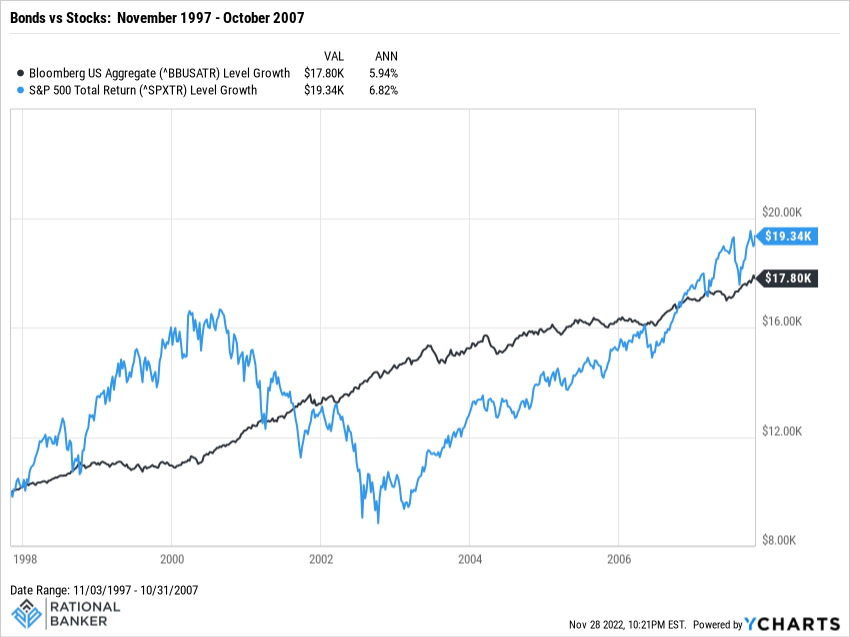

As with the first scenario, we want to look at past performance to highlight the influence of the ending date on an investor’s perception of relative attractiveness (in terms of risk and return). In this scenario, the comparison is between stocks and bonds. We will use the S&P 500 Index and the Bloomberg US Aggregate Bond Index for the comparison. We will look at three different end dates to show the impact that they can have even on long-term results.

Figure 1 displays the 10-year performance to the end of October, 2007 – the month that the S&P 500 peaked prior to the onset of the global financial crisis (GFC). The results show the value of $10,000 invested over the 10-year period in each investment, as well as the annualized 10-year return.

Figure 1

The relative performance displayed above with U.S. equities outperforming U.S. bonds would make sense to investors. This is because equities are considered a higher risk/higher return asset class. In fact, it would be understandable that investors may be surprised that the performance between the two was as close as it was, but that is a separate discussion.

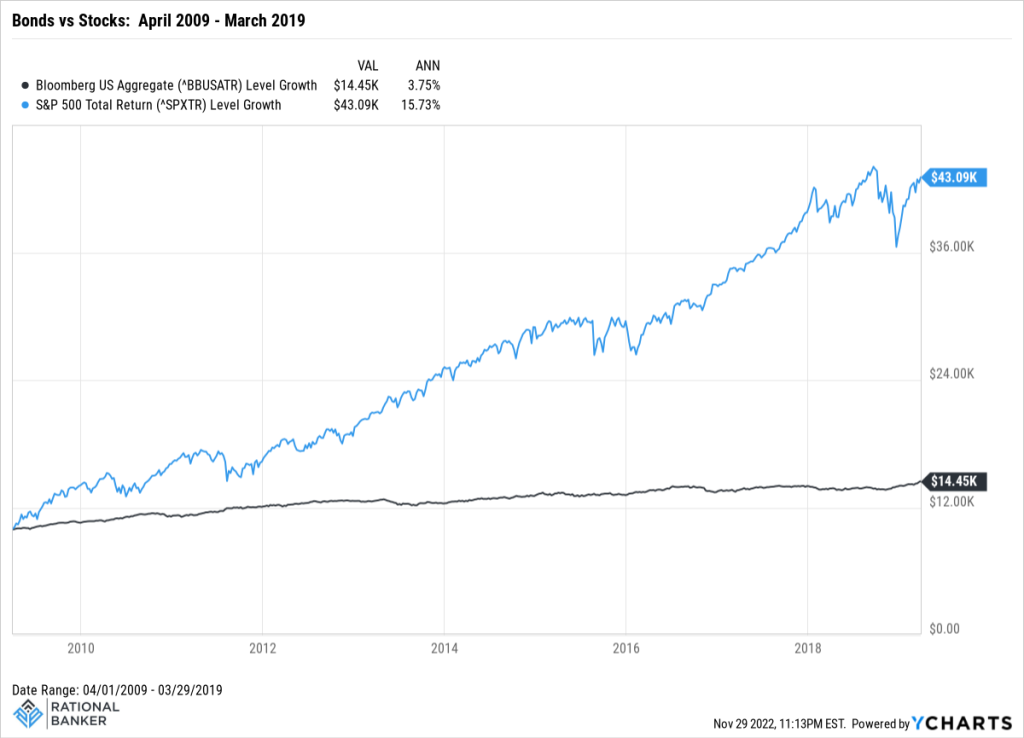

Figure 2 displays the 10-year performance to the end of March, 2009 – which includes the U.S. equity market bottom during the GFC.

Figure 2

Figure 3

The results certainly bring up a familiar expression – hindsight is 20/20! So, after having endured a more than 50% decline from market peak to bottom during the GFC and making a complete shift to fixed income based on the historical performance data in Figure 2, an investor would have been disappointed once again. Their fixed income portfolio grew by an annualized 3.8% per year – not horrible in absolute terms, but on a relative basis the equity exposure they gave up grew by a stunning annualized 15.7% per year! The $10,000 invested in bonds grew to $14,500 while if it had been allocated to stocks it would have grown to a whopping $43,000!

You may think these are extreme scenarios being highlighted. The reality is that there were many individual investors who were truly impacted by the extreme volatility during the GFC. Some made significant changes to their portfolios that reflected the market environment rather than what was suitable for their specific circumstances. By looking to reduce risk exposure in one area, they introduced added risk elsewhere and that may have had material long-term implications on their financial well-being.

Key takeaways

Disclaimer: The above information does not constitute advice, nor is it a recommendation to buy or sell any investments or financial products and services. While the information contained is believed to be accurate, neither Rational Banker nor any persons or entities associated with it an be held responsible for any errors. Prior to making any financial decisions, please do your own due diligence and/or speak with a professional to determine the suitability of such decisions