“Be fearful when others are greedy and be greedy only when others are fearful”

– Warren Buffet

Humans may be the most intelligent species on earth, but we are also creatures of habit.

Depending on the circumstances, that can either be an advantage or a drawback. When it

comes to investing, some habits are well worth trying to avoid or at least mitigate against.

One habit worth kicking is allowing emotions to become prominent when making decisions.

Specifically, the emotions of greed and fear. Greed can become influential particularly during

rising markets as investors may think that additional gains are around the corner. During

market downturns, fear can become the dominant emotion as investors may think that

additional losses are on the horizon. Over time, if these emotions are left unchecked, they can

be very detrimental to our financial well-being.

The reality is, fear and greed continue to play roles in our investment decisions. This is despite

evidence showing the benefits tuning out emotions and sticking to a well-crafted investment

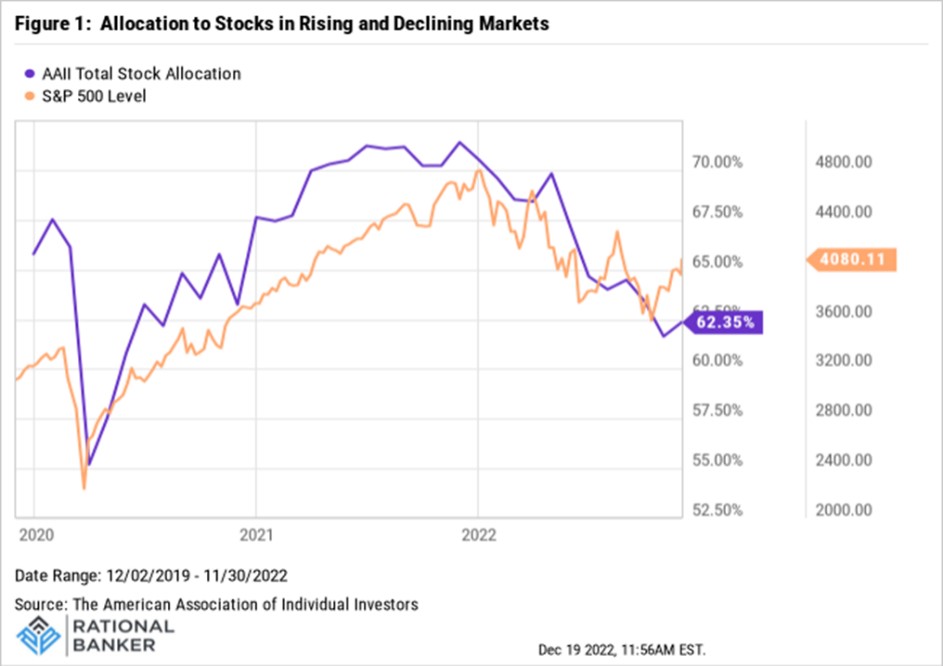

plan. Figure 1 shows the relationship between global equity performance and the total

allocation to stocks by individual investors in the U.S. over the past 3 years. The allocation to

stocks rose alongside rising markets, and declined during downturns.

Ideally, the opposite should be happening in a disciplined investment plan. Long-term

investors would be able to take advantage of market declines by adding exposure to quality

assets at better valuations. When valuations are more expensive, investors would reduce

some of their exposure, taking some profits as the risk-reward profile becomes less

appealing.

So, how do we stop ourselves from this bad habit? There is no definitive answer, but some of the suggestions below can go a long way to helping reduce the risks of buying high and selling low.

Consider working with a professional advisor

Full disclosure, with over 20 years of financial services industry experience, I may have a bias on this suggestion. However, for many investors, a professional advisor can be the difference between financial success and struggle. An experienced advisor can instill the objectivity and discipline needed to help reduce the risk of having emotions drive decisions. Their ability to draw on previous challenging market conditions and how they successfully navigated them can help put current uncertainty into a broader context. This can be very helpful in providing investors with the confidence needed to maintain a long-term perspective. A good advisor can serve as an investor’s safeguard, helping to prevent themselves from becoming their own worst enemy.

Crafting – and sticking to – a customized investment plan

Sound obvious? Maybe, but I am surprised to hear how often people invest without a documented plan that takes their specific circumstances into account. The benefits are certainly worthwhile – provided the portfolio is monitored and measured against it on a recurring basis. This also reinforces a discipline of not having random investments sneak into a portfolio that do not fit as part of the full investment picture. Think about fads or trends that can be tempting for investors to resist. With a plan in place, these investments would face more scrutiny in determining their suitability. Recurring portfolio reviews can identify any material shifts that may have occurred and need to be addressed, or if changes to the investment plan itself are needed to reflect changing circumstances. Doing this regularly can help avoid the possibility of making emotional, knee-jerk changes in response to market volatility instead of those based on rational factors.

Incorporate an automatic (or manual) rebalancing strategy

This is an extension of having an investment plan. Automating or regulating activities can reduce the risk of unhelpful interference in an investment portfolio. Markets go up and down daily. Over time, as market values change, the asset mix of a portfolio can drift away from the target mix. Having your portfolio automatically rebalanced on a regular basis (for example quarterly, semi-annually, or annually) can help mitigate against the risk of having too much (or too little) exposure to different asset classes. Automatic rebalancing can help reinforce buying low and selling high. This occurs by periodically selling a portion of the investments that have grown more compared to the other investments. The proceeds would be used to buy more of the components that have grown less or even declined in value relative to the others.

Establish a dollar-cost averaging strategy

This is probably one of the best ways to maintain commitment to a long-term investment approach. Simply stated, it involves setting aside a specific amount of money that will be put into your investments on a recurring basis – which can be weekly, bi-weekly, monthly, etc. Some people have this taken directly off their paycheque while others have it taken from another account that accumulates cash until it gets automatically withdrawn. The benefit with this approach is that when prices are high, you buy smaller amounts of the investment, and when they are lower, you are buying more. This discipline helps avoid letting greed drive a person to buy more as they see markets roaring higher, and then buy less when they turn fearful because of downside market volatility.

Taking a contrarian view can be practical

When our parents would caution us against following the crowd by asking, “if everyone jumped off a bridge, would you?”, it was to encourage us to think independently. Try to be mindful of that when it comes to investing. If it feels like a particular view or opinion about markets generally or about a specific investment seems to be overwhelming it may be worth stepping back. Be patient, do some additional research on the subject or consult your advisor before making a major investment decision. It is rarely comfortable going against the crowd. However, questioning the narrative might help you make a better decision than going along just because that is what everyone else is doing. Warren Buffet’s quote at the top of this article is a great example of contrarian thinking.

Final Thoughts

Investing is a mix of art and science – some of the decisions are based on measurable, quantifiable data, while other information is subjective and can be interpreted differently from one person to the next. No single set of rules or guide on how to make decisions exists and some of this depends upon the individual’s circumstances. Recognizing that emotions can and do play a meaningful role either consciously or subconsciously is a first step to being able to manage that reality. Some of the ideas discussed above can help serve as risk management strategies to reduce the potential of leaving an investment portfolio vulnerable to our natural emotional tendencies.

Disclaimer: The above information does not constitute advice, nor is it a recommendation to buy or sell any investments or financial products and services. While the information contained is believed to be accurate, neither Rational Banker nor any persons or entities associated with it can be held responsible for any errors. Prior to making any financial decisions, please do your own due diligence and/or speak with a professional to determine the suitability of such decisions.